Social security is a government program that helps workers and retired workers and their families achieve a degree of economic security. Social security programs provide payments to help replace income lost as a result of retirement, unemployment, disability, or death. All industrialized nations, as well as many less developed countries, offer some form of social security. In many countries, social security programs are funded by payroll taxes—sometimes called social security contributions—paid by workers and employers.

Social security differs from welfare, or public assistance. Social security pays benefits to individuals and their families largely on the basis of their work histories. Welfare, on the other hand, aids the poor largely on the basis of financial need. See Welfare.

Social Security in the United States

The United States government provides its main social security benefits through the old-age, survivors, disability, and health insurance (OASDHI) program—commonly known as Social Security, with two capital letters. The program consists of two parts: (1) old-age, survivors, and disability insurance (OASDI) and (2) Medicare. The U.S. government administers OASDI through an independent agency called the Social Security Administration (SSA). The Health Care Financing Administration, an agency of the U.S. Department of Health and Human Services, manages Medicare.

Social Security covers most U.S. workers, including nearly all workers in private industry and most public employees. Workers in jobs covered by the program are required to have a Social Security number. This number enables the SSA to keep a record of the worker’s earnings. Any U.S. resident may apply for a Social Security number, and a printed Social Security card, at a local Social Security office. Applicants must present proof of age and citizenship or alien (noncitizen) status.

Social Security does not cover some state and municipal employees and certain self-employed people. It also does not cover some foreign workers admitted temporarily to the United States. Most workers who are not covered by Social Security contribute to other retirement and disability funds.

Old-age, survivors, and disability insurance

forms the foundation of the U.S. Social Security program. It provides payments to workers or their families after the workers reach a certain age, die, or become disabled.

Eligibility.

Workers or their families become eligible for OASDI benefits after the workers earn a specified number of work credits—also called quarters of coverage—in jobs covered by Social Security. The number of work credits people receive depends on the amount of money they make per year. But workers may receive no more than four work credits per year, no matter how much money they earn.

A worker earns full and permanent OASDI coverage if he or she has a total of 40 work credits. A worker or a worker’s family may also receive benefits based on the number of credits earned between the age of 21 and the year of the worker’s disability or death. Other eligibility rules apply if a worker becomes disabled before the age of 31 and in certain other cases.

Benefits.

To collect OASDI benefits, individuals and families must file a claim with the Social Security Administration. Benefits are paid monthly, except for lump-sum death payments.

Insured workers may collect full retirement benefits when they reach the full retirement age, as defined by the government. In the United States, full retirement age is 66 or 67, based on a person’s date of birth. Workers age 62 and older may choose to collect retirement benefits before they reach the full retirement age. However, such workers receive a permanently reduced benefit.

To collect disability benefits, workers must have a severe physical or mental condition that affects their ability to perform the activities of everyday life. The condition must have lasted at least 12 months, or it must be expected to last that long or to result in death.

Social Security also provides benefits to the families of retired workers or workers with disabilities. Spouses may collect full benefits when they reach the full retirement age. A spouse’s full benefit equals 50 percent of the worker’s benefit. Spouses may collect reduced benefits as early as age 62. If a spouse has his or her own working record, he or she may choose between collecting worker’s benefits or collecting spouse’s benefits. Under certain conditions, additional benefits may be paid to a worker’s child, to a spouse or other adult who provides care for a worker’s child, or to a former spouse.

When an insured worker dies—either before or after retirement—the worker’s dependents may be eligible for a monthly survivors benefit. Payments are based on the benefits the worker was receiving at the time of death or would have received at retirement. The spouse also receives a small single lump-sum payment after the worker’s death to help cover funeral expenses.

How benefits are figured.

The amount workers receive in OASDI benefits depends on their average lifetime earnings, over a maximum of 35 years, in jobs covered by Social Security. A worker who has paid a large amount in Social Security taxes receives a greater benefit than a worker who has paid less. However, workers with lower lifetime earnings collect benefits that are greater in proportion to their earnings. When calculating OASDI benefits, the government wage-indexes the worker’s covered earnings. Wage-indexing involves adjusting the earnings record to reflect the average increase in wages over time. The government also raises benefits to reflect increases in the cost of living.

Workers who choose to collect retirement benefits before the full retirement age receive reduced benefits. The amount of reduction depends on their age at retirement. Workers who retire at age 64, for example, receive a higher monthly benefit than those who retire at age 62. People who work beyond the normal retirement age without claiming benefits collect a bonus called the deferred retirement credit. This bonus provides an eventual increase in benefits to make up for the years that fully eligible workers did not claim benefits.

Total benefits payable on a worker’s earnings record each month may not exceed an amount called the maximum family benefit. This amount varies from 150 to 180 percent of the worker’s basic monthly benefit. When the total benefits exceed the maximum, each individual benefit is proportionately reduced. Some higher-income individuals and couples must pay federal income tax on their benefits. This tax revenue helps finance the Social Security program.

Medicare

is a government health insurance program that covers nearly all people age 65 or older. It also covers certain people with kidney disease and people who have received Social Security disability benefits or Railroad Retirement Board disability benefits for at least two years. The program includes hospital insurance, medical insurance, and prescription drug coverage.

Hospital insurance helps pay for hospital care, certain skilled nursing facility care, and home health services. Medicare also has an optional hospice benefit for terminally ill patients. Hospice care is a type of home-centered health care for people dying of an incurable illness. People entitled to Social Security or Railroad Retirement Board benefits automatically qualify for hospital insurance at age 65, even if they continue to work.

Medical insurance helps pay the cost of physicians’ services and certain other costs that hospital insurance does not cover. Almost all Medicare beneficiaries participate in medical insurance.

Prescription drug coverage helps people pay for generic and brand-name prescription drugs. Members have a choice of plans, operated by private companies, that provide different types of drug coverage. Each state government determines the selection of available plans.

People age 65 or older who are ineligible for retirement benefits may obtain Medicare coverage by paying a monthly premium. For certain low-income individuals who are disabled or age 65 or older, a welfare program called Medicaid pays some or all of the medical expenses and premiums that Medicare beneficiaries usually must pay. Individual state governments administer their own state Medicaid programs and provide most of the funding.

Financing Social Security.

A payroll tax shared equally by employers and workers finances the OASDHI program. This payroll tax is called the Federal Insurance Contributions Act (FICA) tax. Each worker’s annual income, up to a certain fixed amount, is subject to the tax. This amount is called the wage base. The wage base is the same for each employee. However, it changes from year to year, depending on the cost of living. Self-employed workers also pay a FICA tax, but they are allowed tax deductions that result in their getting back half the amount paid. All earnings of all workers are subject to the Medicare portion of the FICA tax.

Employers deduct the FICA tax from workers’ income each pay period. They then add an equal contribution and send the amount periodically to the Department of the Treasury. The department distributes most of the money to the Old-Age and Survivors Insurance Trust Fund and the Disability Insurance Trust Fund. These funds pay the appropriate benefits. The rest of the FICA revenue goes to the Hospital Insurance Trust Fund, which finances Medicare’s hospital insurance. The U.S. government’s general revenues pay most of the cost of Medicare’s medical insurance. Participants in the medical insurance program pay the rest through monthly premiums.

Funding issues.

The FICA required to keep the Social Security system solvent continually changes, and Congress has always periodically adjusted the program. In 1983, Congress passed legislation that sought to protect the financial health of the Social Security system over the next 75 years. For the first time, Congress reduced future benefits while it raised taxes to boost future revenue. The law accelerated parts of a previously scheduled tax increase and expanded the categories of workers covered under Social Security. It required all federal employees hired after 1983 to join the system. The law also required some higher-income retirees to pay federal income taxes on up to 50 percent of their benefits. The resulting revenues were added to the Social Security trust funds. In addition, the law required a gradual rise in the full retirement age.

From the mid-1960’s through the mid-1980’s, the taxpaying labor force was enlarged by the entry of the baby boom generation. Baby boomers are the group of people born during a period of high birth rates from 1946 to 1964. As a result, during the late 1900’s, the number of workers paying taxes into the Social Security system grew more rapidly than the number of retirees collecting from the system.

As large numbers of baby boom retirees began collecting retirement benefits in the 2010’s, tax revenues began falling below program costs. The Social Security Administration estimates that OASDI trust funds will become depleted in 2035, thus reducing Social Security benefits.

Proposed changes.

To address funding problems, Congress has considered a number of changes to Social Security. Suggested changes have included increases in tax rates, changes in the ways benefits are calculated, and reductions in benefits for higher-income workers. Many people favor further expansion of the categories of workers who must participate in Social Security, more increases in the retirement age, or further rises in the percentage of benefits that are subject to income taxes. Some proposals have involved the movement of Social Security funds into individual investment accounts.

Other U.S. programs

Workers in the United States may receive other social security benefits through unemployment insurance and workers’ compensation programs.

Unemployment insurance

provides weekly payments to workers who have lost their jobs through no fault of their own and are seeking work. It covers civilian federal employees, former military personnel, and most workers in commerce and industry who are not self-employed. It also covers state and local government workers and workers in nonprofit organizations.

The state governments administer the unemployment insurance system and determine the benefits. But federal law requires that state programs meet certain standards. Unemployment insurance is financed chiefly by a payroll tax on employers. The states determine the rate employers must pay. In a few states, employees also contribute.

To qualify for benefits, an unemployed person must have worked for a certain period in a job covered by unemployment insurance, or must have earned a certain amount of income, or both. Unemployed workers must apply for benefits at a state unemployment office. They also must register for employment and be willing to take a suitable job.

Unemployment benefits vary. Most states base them on the person’s average earnings during a specified number of months prior to unemployment. Benefits generally equal about half the worker’s full-time weekly pay, within minimum and maximum limits. A few states pay extra benefits to workers with dependents. The period during which workers may collect benefits also varies. All states extend the maximum benefit period during times of high statewide unemployment.

The Tax Reform Act of 1986 made all unemployment benefits subject to federal income tax. In addition, some states require recipients to pay state income tax on their benefits.

Workers’ compensation

provides medical benefits and payments for lost wages to workers who suffer a work-related injury or illness. It also pays death benefits to the dependents of workers who die from a job-related injury or disease. Most states require employers to provide workers’ compensation coverage. But some states limit coverage for farm and domestic workers as well as for workers in small businesses.

Most workers’ compensation programs are administered by state agencies known as workers’ compensation boards or industrial commissions. Many employers obtain coverage for their employees through insurance companies or by establishing their own insurance funds. Some states provide a fund through which employers may obtain coverage. Most states limit the size of benefit payments and may limit the benefit period or the total paid to any individual. Injured workers normally receive about two-thirds of their salary while disabled.

Social security in Canada

Canada’s social security system has three main parts: (1) the Old Age Security program, (2) the Canada Pension Plan, and (3) unemployment insurance. A government department called Human Resources and Social Development Canada administers the country’s social security programs.

The Old Age Security program

provides a modest retirement income to people age 65 or older who have lived in Canada for at least 10 years. To receive this pension outside Canada, the person must have lived in Canada for at least 20 years. Beneficiaries are paid benefits regardless of their work records. Benefits, which are paid monthly, rise automatically with the country’s cost of living. Low-income beneficiaries receive an additional benefit called the Guaranteed Income Supplement.

The Canada Pension Plan

provides additional monthly benefits to retired workers, workers with disabilities and their children, and the spouse and children of deceased workers. The plan also provides a death benefit in a single payment to the estate of a covered deceased worker. Workers must be 60 or older to collect a retirement pension under the plan. Retirement benefits are based on workers’ earnings and their contributions to the plan. The plan is financed by a payroll deduction. Employers and workers pay separate taxes on the worker’s earnings. Self-employed workers pay both the employer’s and worker’s shares.

Participation in the plan is required for all workers from the ages of 18 to 60 who earn more than an annual minimum. Workers from 60 to 70 continue to participate if they are not yet receiving a retirement pension under the plan. Workers in the province of Quebec do not participate in the plan. Instead, they are covered by a similar program, called the Quebec Pension Plan.

To qualify for disability and survivors benefits, workers must have contributed to the pension plan for a specified period. Such benefits equal a fixed amount plus a percentage of the retirement pension to which the worker would be entitled. Benefits are adjusted yearly to reflect increases in the cost of living.

Unemployment insurance

covers almost all Canadian workers. To receive benefits, an unemployed worker must have worked in an insured job for a minimum number of weeks. The number of weeks depends on how long the person has worked and on the unemployment rate in the region where the worker lives. Generally, the weeks worked must fall within the year before the person filed for benefits. The worker also must have worked a minimum number of hours per week or earned a minimum amount of money per week. Some unemployed workers are eligible for maternity, illness, and parental benefits.

Unemployment insurance is financed by premiums paid by employers and employees. Premiums are paid into the Unemployment Insurance Account, which is administered by Human Resources and Social Development Canada.

Social security in other countries

Social security systems vary from one country to another. In the United Kingdom, the government provides a basic state pension for people above a certain age who have paid taxes into the National Insurance system. People who have contributed large amounts to the National Insurance system may also be eligible for a state second pension. In addition, the British government provides unemployment insurance and a minimum pension for people in need.

In Australia, the government provides unemployment insurance and two main programs for retirement income. The first is a federal means-tested pension, which covers nearly all workers and is supported by general government funds. The second is a system of individual accounts that employers are required by law to support. In Japan, there is a social security council that oversees programs to ensure that all Japanese people can maintain an adequate standard of living. In India, the government does not have a universal social security system. Instead, a number of laws provide benefits for different segments of the nation’s workforce.

In many less developed countries, there is no social security system. Retired workers and workers with disabilities in such countries may have to rely on their children or other relatives for financial security.

History

The Industrial Revolution of the 1700’s and early 1800’s led to the development of social insurance in Europe. During this period, many people moved from rural areas to cities and found work in factories. Most of the workers received low wages, and many labored under dangerous working conditions. In many cases, workers were unable to save for old age because their wages were so low. If they became disabled in job-related accidents or lost their jobs during business slumps, workers and their families suffered hardships.

During the late 1800’s, Germany began to adopt laws to improve conditions for workers. The German government established the first sickness insurance law in 1833 and the first workers’ compensation act in 1884. By 1889, Germany had passed the first compulsory old-age and disability insurance program.

By the early 1900’s, most European countries had enacted basic social security programs similar to Germany’s. The United Kingdom adopted its social security system in 1908. Australia introduced its program the same year.

The United States was one of the last major industrialized nations to establish a social security system. In 1911, Wisconsin passed the first state workers’ compensation law to be held constitutional. At that time, most Americans believed the government should not have to care for the aged, the needy, or people with disabilities. But such attitudes changed during the Great Depression of the 1930’s. Many Americans realized that economic misfortune could result from events over which workers had no control.

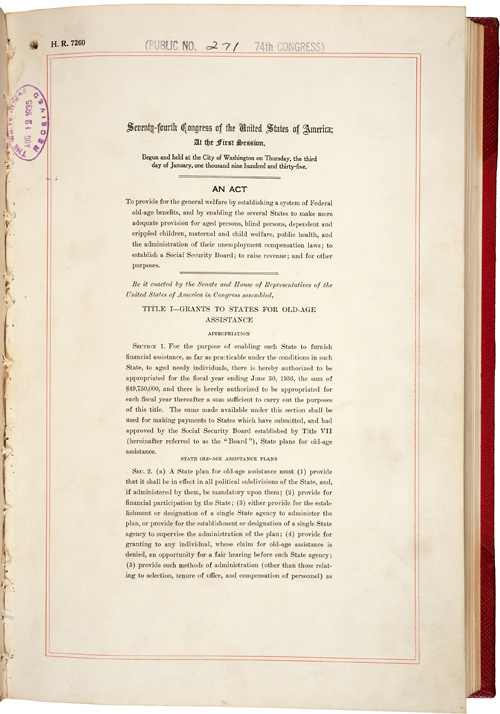

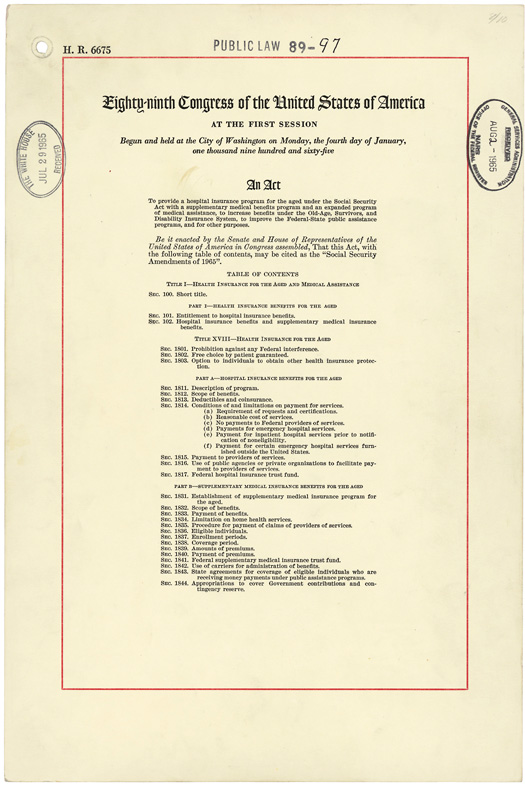

In 1935, the U.S. Congress passed the Social Security Act, which formed the basis of the U.S. Social Security system. It provided cash benefits only to retired workers in commerce and industry. In 1939, Congress amended the act to include benefits for wives and dependent children of deceased workers. In 1950, the act began to cover many farm and domestic workers, nonprofessional self-employed workers, and many state and municipal employees. Coverage became nearly universal in 1956, when lawyers and other professional workers came under the system. Congress added disability insurance to the system in 1956 and set up Medicare in 1965.

Canada’s system began in 1940, when the Canadian Parliament passed the Unemployment Insurance Act. Parliament amended the act in 1971 to cover nearly all employees. The Canada Pension Plan went into effect in 1966, and the payment of retirement benefits began in 1967. The Quebec Pension Plan was established in 1965.