Stock exchange is a marketplace where brokers act as agents for the public in buying and selling stocks and bonds. Stock exchanges provide a service to business and society. People invest money in securities (stocks and bonds) in hopes of gaining more money in the future. These investments make money available to companies and governments, thus enabling them to provide goods and services. Some of the trades made with these investments are completed in stock exchanges.

In the United States, major stock exchanges operate in New York City, New York, and Chicago, Illinois. Major exchanges in other countries include those in Frankfurt, Germany; Hong Kong and Shanghai, China; Johannesburg, South Africa; London, United Kingdom; Sydney, Australia; Tokyo, Japan; Toronto, Canada; and Zurich, Switzerland. The emergence of firms that trade stocks electronically on the internet has challenged traditional stock exchanges.

How a stock exchange operates

At a stock exchange, only brokers who are members of the exchange can buy and sell securities. At most exchanges, brokers must pay a fee and meet certain membership requirements before they can obtain a seat (membership). Only a limited number of seats are available at each exchange.

Stocks traded on exchanges are known as listed stocks. A company that wants its shares listed must qualify under the rules of the exchange. For many exchanges, a company must show that it possesses a certain amount of capital, is a lawful enterprise, and is in good financial condition. Listed bonds may also be traded on stock exchanges. Unlisted stocks and most bonds are bought and sold in over-the-counter trading, which takes place outside of stock exchanges.

Stock prices and indexes.

All stocks fluctuate (change) in value. Unforeseen circumstances may diminish the earning power of a company and thus lower the price investors are willing to pay for its stock. Prosperous times or improved management may increase the value of a stock. Other circumstances—such as improved management or the introduction of new products—may increase the value of a stock. Stock prices often reflect the state of a country’s economy. If business conditions are good, stock prices have a tendency to rise, creating what is called a bull market. If business conditions are poor, stock prices drop, causing a bear market.

All stock exchanges have at least one stock index. Stock indexes are numbers that measure the overall rise and fall of stock prices on an exchange. Dow Jones averages are indexes for stocks traded in the United States. Other major indexes include the Financial Times Stock Exchange Index, which tracks prices on the London Stock Exchange, and the Nikkei Index, which tracks prices on the Tokyo Stock Exchange.

Trading.

An investor who wishes to buy or sell shares of stock can place an order with a brokerage company, or brokerage house. Once an order is placed, the company relays the instructions to a broker at the exchange, who makes the transaction. Brokers receive commissions (transaction fees) for their services. Many investors use online brokerage services to conduct transactions over the Internet.

Stock is often traded under a contract called an option. An option allows the stockholder to buy or sell a certain amount of stock at a specific price within a designated period. For example, an investor may believe that a stock will increase in value. The investor can buy an option that will allow the purchase of shares of that stock at a specific price before a certain date. If the value of the stock rises above the price set by the option, the holder can profit by buying the stock and immediately reselling it.

Information about stock transactions appears on electronic displays called stock tickers. Brokers and investors throughout the world use stock tickers to keep informed of stock market developments.

Regulation.

Countries throughout the world have laws that regulate the issuance, listing, and trading of securities. In the United States, the Securities and Exchange Commission (SEC) administers federal laws concerning stock exchanges. Additional laws exist at the state level. In Canada, stock exchanges are regulated primarily at the provincial and territorial levels. The Financial Services Authority is an independent, nongovernmental body that regulates financial markets in the United Kingdom.

History

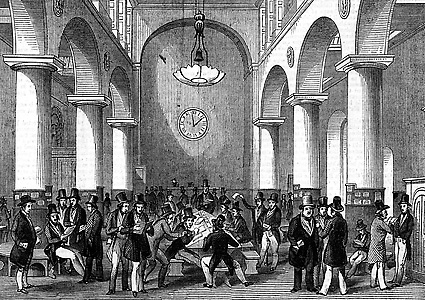

The first European stock exchange was established in Antwerp, Belgium, in 1531. The first stock exchange in England was formed in 1773 by the brokers of London. Before that time, people who wished to buy or sell stock had to find a broker to conduct the transactions. In London, brokers traditionally gathered at coffee houses.

In New York City, brokers met under an old buttonwood tree on Wall Street. They became known as “curbstone brokers.” In 1792, they established the New York Stock Exchange, the oldest and largest stock exchange in the United States. Another major U.S. stock exchange, the American Stock Exchange, was formerly called the New York Curb Market, then the New York Curb Exchange, because of its origins on the streets of New York City.