Clearinghouse is an institution used by banks to exchange checks and to establish claims against each other that result from financial transactions. Clearinghouses may be formal institutions with written rules and regulations, or they may consist of informal arrangements among banks. Nearly every city in the United States with more than two banks has a clearinghouse operated by an association of local banks. Formal clearinghouses operate in most large U.S. cities. Banks collect most checks drawn on out-of-town banks through Federal Reserve Banks or through commercial banks called correspondent banks. The rest of these checks are exchanged directly with banks in other cities.

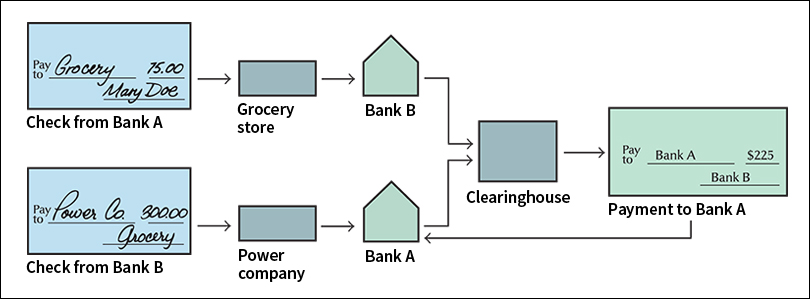

A clearinghouse allows banks to settle their debts with one another with the smallest possible exchange of funds. Suppose you have a checking account at Bank A and write a check for $75 at a grocery store. The grocery store deposits the check in its account at Bank B. The grocery store then sends a check for $300 to the power company, which deposits the check in its account at Bank A. The banks send the two checks to the local clearinghouse.

The clearinghouse would examine the checks and find that Bank A owes $75 to Bank B, and Bank B owes $300 to Bank A. Both debts could be settled at once if Bank B paid $225 to Bank A. Actually, a clearinghouse may handle thousands or millions of checks and other transactions daily. The dollar amounts tend to offset each other, leaving much smaller amounts to be transferred between the banks.

Almost all U.S. banks that use a formal clearinghouse have an account at their district Federal Reserve Bank. The clearinghouse gives the Federal Reserve Bank information that allows settlement between banks through their Federal Reserve accounts. In some cases, banks that use a particular clearinghouse settle claims against each other through accounts at one of the user banks.

The first clearinghouse was formed in London in the late 1700’s. In 1853, New York City banks formed the first clearinghouse in the United States. In 1970, the Clearing House Interbank Payments System (CHIPS) began operating in New York City. This system handles electronic fund transfers that are related to international financial transactions. Its computer network provides settlement information to the Federal Reserve Bank of New York.