Federal Reserve System, an independent agency of the United States government, is the central banking system of the United States. As the central bank, the Federal Reserve, often called the Fed, has many jobs. These include issuing currency and managing the money supply (the total amount of U.S. currency and bank deposits held by people and by private financial institutions). The Fed also makes loans to commercial banks and provides check-clearing services to and supervision of the U.S. financial system. The Fed is most often in the news when it conducts monetary policy—altering the money supply to influence economic activity and the overall health of the economy.

Organization.

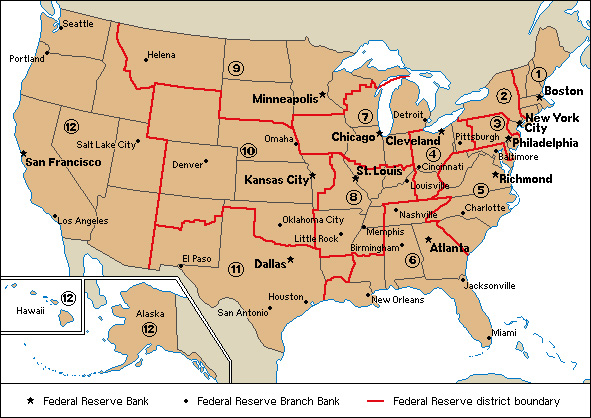

The Federal Reserve System is made up of a seven-member Board of Governors in Washington, D.C., and 12 Federal Reserve Banks across the United States. Each Federal Reserve Bank has a president and its own district. Most districts have from one to five Federal Reserve Bank branches.

The Board of Governors administers the system. The U.S. president appoints each of its members to a 14-year term. The president names one member to serve as chairman for four years. A chairman is often reappointed for more than one term.

The Federal Open Market Committee of the Fed decides the direction of U.S. monetary policy. The committee consists of the Board of Governors, the president of the New York district Federal Reserve Bank, and the presidents of four other Federal Reserve Banks. The presidents of the Federal Reserve Banks outside the New York district serve on a rotating basis.

The Fed operates more independently of the president and Congress than do typical government agencies. Because the governors serve 14-year terms, each president appoints no more than a few. As a result, the president cannot fill the board with governors who favor a particular political policy. The Fed also has far more financial independence than most agencies because it raises all its operating expenses from investment income and service fees. The Fed reports to Congress about its proposed policies, but it is legally free to make its own policy decisions.

Many economists support the independence of the Fed—and other central banks. They believe that executive and legislative branches of government have less motivation than central banks do to reduce inflation when necessary. Inflation is a continual increase in prices throughout a nation’s economy. The independence of the Fed, however, is not absolute. Congress created the agency, and Congress can abolish it.

Monetary policy.

The Fed controls the nation’s money supply to support a stable, healthy economy. A healthy economy is one in which output grows over time, people looking for jobs can find them, and prices for things people buy do not rise quickly (that is, inflation is kept in check). By changing the money supply, the Fed can increase or decrease the average rate of interest lenders in the economy charge borrowers, which influences borrowing and spending by consumers and businesses, or economic activity. The Fed slows economic activity by raising interest rates if it believes prices are rising too quickly. It lowers interest rates if it hopes to reduce the level of unemployment. The Fed changes the money supply by (1) using open market operations, (2) changing the discount rate, and (3) changing reserve requirements.

Open-market operations

are the primary tool the Fed uses to carry out its monetary policy. They involve the sale or purchase of government securities, including Treasury bills (T-bills), bonds, and notes. When the Federal Open Market Committee wants to increase interest rates, it can direct the New York district Federal Reserve Bank to sell government securities in the “open market.” When private banks purchase the securities, they have fewer reserves (see Reserve requirements below) to loan out. As loans decrease, demand deposits (checking accounts) decrease, reducing the money supply. Interest rates rise as borrowers compete for loans. If the Fed wants to reduce interest rates, it buys back government securities on the open market.

The discount rate

is the interest rate banks pay when they borrow money from a Federal Reserve Bank. By raising the discount rate, the Fed can increase the cost to banks for making loans. As a result, banks raise interest rates, which leads to a decrease in the money supply. Lowering the discount rate has the opposite effect.

Reserve requirements

are percentages of deposits that deposit-taking institutions must set aside either as currency in their vaults or as deposits in their district Federal Reserve Bank. An institution can use the rest of its deposits to make loans. Raising the reserve requirement reduces the amount of reserves banks have available for loans, reducing the money supply and causing interest rates to rise. Lowering the reserve requirement has the opposite effect. The Fed uses changes in the reserve requirements far less often than it uses open-market operations or changes in the discount rate.

Other Fed activities.

The Fed has other responsibilities as well. It acts as the bank for the government by holding deposits for the Treasury and other federal agencies. It also holds reserves for private banks and processes checks between these banks. During financial crises, the Fed often becomes the “lender of last resort,” making loans to banks and other financial institutions that have serious financial difficulties. Along with other federal agencies, the Fed also oversees and regulates commercial banks and financial institutions to ensure the stability of the U.S. financial system.

History.

During the 1800’s and early 1900’s, financial panics occasionally rocked the banking system in the United States. These panics were often accompanied by runs on banks, in which many depositors would attempt to withdraw their money from a bank at the same time. During most of this period, the United States did not have a central bank to help stabilize its banking system and prevent panics.

Two early attempts to form a central bank for the United States failed. The First Bank of the United States operated from 1791 to 1811, and the Second Bank of the United States operated from 1816 to 1836. A financial crisis in the early 1900’s led Congress to pass the Federal Reserve Act of 1913. This act established the Federal Reserve System as the nation’s central bank.

The Banking Act of 1933 created the Federal Open Market Committee. With this act, the Banking Act of 1935, and provisions in the Employment Act of 1946, Congress gave all authority over U.S. monetary policy to the Fed.