Antitrust laws are designed to protect competition and consumers. They prohibit price fixing agreements, in which business firms agree on the price they will charge for products or services. They also outlaw mergers—that is, the joining of business firms—that interfere with competition. In addition, antitrust laws prohibit firms from using their economic power to gain or maintain a monopoly. While the United States pioneered antitrust laws, many other nations have adopted such laws. In the United States, both the federal government and state governments have antitrust laws. This article discusses federal antitrust legislation.

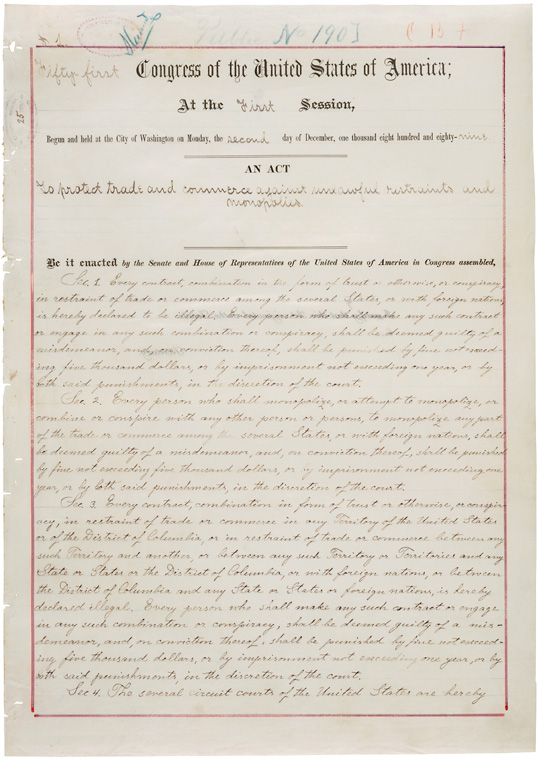

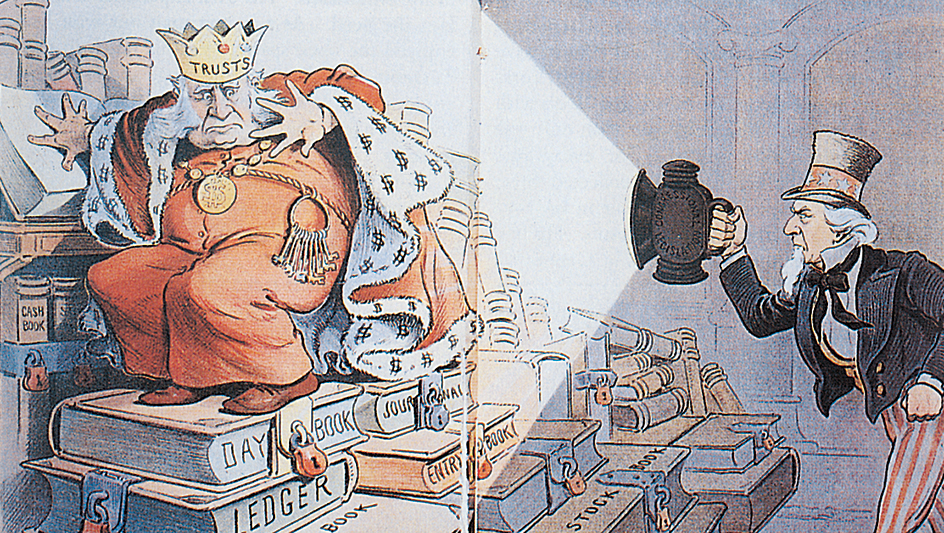

During the late 1800’s, business leaders, such as John D. Rockefeller, bought up or stamped out many of their competitors. They then brought their surviving competitors under informal common control in organizations called trusts. The trusts limited production and raised prices. A public outcry against abuses by the trusts led to the passage of the Sherman Antitrust Act in 1890. The act outlaws any contract, combination, or conspiracy in restraint of trade. It also prohibits any person or business from monopolizing or trying to monopolize any market.

During the early 1900’s, the federal government sued and broke up existing oil, tobacco, and farm machinery trusts, as well as several others. But many companies continued to grow by merging with or buying competing firms. Also, many businesses sought to eliminate competition by buying the stocks of their competitors and by forcing their customers to sign exclusive dealing contracts, or to buy goods they did not want, in order to acquire the goods they needed. Many of these practices were allowed by the courts.

In 1914, Congress responded to these practices by passing two laws that gave support to the Sherman Antitrust Act. The Clayton Antitrust Act outlaws price discrimination that gives favored buyers an advantage over others. It also forbids anticompetitive agreements in which manufacturers sell only to dealers who agree not to handle the products of a rival manufacturer. In addition, the act prohibits mergers that lessen competition. The Federal Trade Commission Act established the Federal Trade Commission (FTC). This government agency works to prevent unfair and anticompetitive business practices.

Despite the Clayton Act and the Federal Trade Commission Act, companies continued to make anticompetitive mergers and acquisitions. The Celler-Kefauver Act of 1950 strengthened the Clayton Act by tightening control over mergers that might reduce competition.

In 2000, a U.S. district court judge ruled that Microsoft Corporation had violated antitrust laws by abusing its monopoly in personal computer operating systems. In 2002, Microsoft and the U.S. Department of Justice agreed to a settlement that a federal judge determined to be agreeable to the company, the government, and the public. In 2004, the European Union (EU) found Microsoft guilty of additional antitrust violations. The EU fined Microsoft and required the company to change its business practices.

The late 1900’s and early 2000’s marked a lowering of trade barriers worldwide. As a result, opportunities for competition grew. But an increase in the number of large corporate mergers also occurred. Debate continues over whether a successful global economy requires more or less antitrust control. Some people argue that business can best respond to consumer needs if left alone. Others feel that strict enforcement of antitrust laws is necessary to protect competition and consumers.

See also Monopoly and competition (History).