Great Depression was a worldwide economic slump of the 1930’s. It ranked as the worst and longest period of high unemployment and low business activity in the 1900’s. Banks, factories, and shops closed, and farms halted production. Millions of people were left jobless and penniless. Many people had to depend on the government or charity to provide them with food.

In the United States, the decline in industrial production began in the second half of 1929. The economic downturn worsened in October 1929, when values of stocks dropped dramatically. Thousands of shareholders lost large sums of money, and by 1930, consumer spending had fallen sharply. Many other countries—especially major producers of raw materials and agricultural goods—experienced a decline in economic activity in the late 1920’s. Rising unemployment, declining production, and falling prices spread rapidly to the rest of the world in the early 1930’s. The Depression caused a decrease in world trade, as countries tried to help their own industries by increasing restrictions on imports. The impact of the Great Depression varied from country to country.

Loading the player...Great Depression

The Great Depression had significant effects on people’s beliefs and on government policies. It caused some nations to change their leaders and their types of government. In the United States, President Herbert Hoover held office when the Great Depression began. But soaring unemployment and declining output led to the election of Franklin D. Roosevelt in 1932. The Roosevelt administration introduced a number of policies that transformed the role of the government in the economy.

The Depression affected the governments of other nations as well. The poor economic conditions contributed to the rise of the German dictator Adolf Hitler and to the Japanese invasion of China. The German people supported Hitler in part because his plans to make Germany a world leader gave them hope for improved conditions. The Japanese developed industries and mines in Manchuria, a region of China now called the Northeast, and claimed that this economic growth would relieve the Depression in Japan. The militarism of Germany and Japan helped bring about World War II (1939-1945).

Recovery from the Depression began as many countries devalued (lowered the value of) their currencies and increased the money supply—that is, the amount of money in circulation. Economic conditions further improved after nations increased their production of war materials at the start of World War II. This increased level of production substantially reduced unemployment.

The beginning of the Great Depression

Many factors helped set the stage for the Great Depression. In Europe, World War I (1914-1918) caused devastation and economic chaos. Many countries struggled to adjust to postwar inflation (price increases). The United States experienced a major agricultural slump and a number of bank failures in the 1920’s. And the stock market crash of 1929 caused many people to panic and lose confidence in the state of the economy.

Aftermath of World War I.

World War I cost the fighting nations a total of about $337 billion. Nations raised part of the money through taxes. But most of the money came from borrowing, which created huge debts. In addition, many governments printed extra money to meet their needs. The increased money supply caused severe inflation after the war.

Many businesses shut down after workers left for military service. Other businesses shifted to the production of war materials. Global agricultural markets expanded greatly in Australia, Canada, South America, and other areas to meet wartime demand. After the war ended, Europe faced new competition in many export markets. In most European countries, many returning soldiers could not find jobs.

The gold standard.

Prior to World War I, many countries used the gold standard—that is, they set the value of their national currencies at a certain weight of gold. Under this standard, the rates at which one currency could be exchanged for another were fixed by their values in gold. But during the war, many governments abandoned these fixed exchange rates to help finance their debts from the war.

After the war ended, most governments brought back the gold standard in an effort to provide price stability and to halt inflation. However, the return to fixed currency values hurt many countries that had seen prices rise following the war. The return to the gold standard also limited the ability of government leaders to offset declining production and prices by increasing the amount of money in circulation.

The farm depression and bank failures.

As economies recovered from World War I, stock markets in many countries soared. However, most U.S. farmers during this time did not prosper. As a result of increased global production, prices of farm products fell by about 40 percent in 1920 and 1921, and they remained low throughout the 1920’s. Some farmers, who had hoped that the high prices and expanded production opportunities of wartime would continue, borrowed heavily. Many of these farmers lost so much money that they could not pay the mortgages on their farms. These farmers then had to either rent their land or move.

Bank failures increased during the 1920’s. Most of them occurred in agricultural areas because farmers experienced such poor conditions. More than 5,000 U.S. banks went out of business from 1921 to 1929.

The stock market crash.

During the 1920’s, demand for consumer goods and new products such as radios, electrical appliances, and automobiles led to increased production and business profits. Many of these goods were purchased using installment contracts, by which goods are purchased on credit and ownership is transferred after the last payment is made.

From 1925 to 1929, the average price of shares on the New York Stock Exchange more than doubled. Rising share prices encouraged many people to speculate—that is, buy shares in hope of making large profits following future price increases. In 1928 and 1929, the Federal Reserve System—the central banking organization of the United States—raised interest rates in an effort to slow stock market speculation. The higher interest rates led to a reduction in consumer spending and construction spending.

Share prices dropped rapidly on Thursday, Oct. 24, 1929. Most share prices remained steady on Friday and Saturday. But the following Monday, share prices fell again. Then, on October 29, now known as Black Tuesday, shareholders panicked and sold a record 16,410,030 shares. Thousands of people lost huge sums of money as share prices fluctuated and fell for the next three years. Share prices dropped about 89 percent from their pre-Depression high point in September 1929 to their lowest value during the Depression in July 1932.

Increased uncertainty about the future of the economy led consumers to cut back on purchases of goods and services. In addition, to avoid being unable to pay for goods purchased on installment plans, many consumers further reduced their spending. As a result of the dramatic decline in consumer spending, output and production fell sharply in late 1929 and in 1930.

The higher interest rates in the United States helped spread the Depression to other parts of the world. To maintain a fixed exchange rate with the United States, other countries had to raise their interest rates as well. The higher interest rates led to reductions in household and business spending, which in turn led to declines in production. See Interest (Events that cause interest rates to vary) .

The deepening Depression in the United States

From October 1929 until early 1933, the U.S. economy slumped almost every month. Business failures increased rapidly among banks, factories, and stores, and unemployment soared. Millions of people lost their jobs, savings, and homes.

Economic breakdown.

Because of falling stock prices, banks and investors lost large sums of money. Banks had also loaned money to many farmers and businesses who were unable to repay it. Bank profits declined, and bank customers worried that their savings were not safe. Many customers withdrew their money from the banks, further straining the health of the banking system. Between January 1930 and March 1933, about 9,000 banks failed. The bank failures wiped out the savings of millions of people.

Bank failures made less money available for loans to industry. The decline in available money caused a drop in production and a further rise in unemployment, and it severely prolonged the Depression. The Federal Reserve could not increase the money in circulation because the U.S. maintained a fixed exchange rate. From 1929 to 1933, the total value of goods and services produced annually in the United States fell from about $104 billion to about $56 billion.

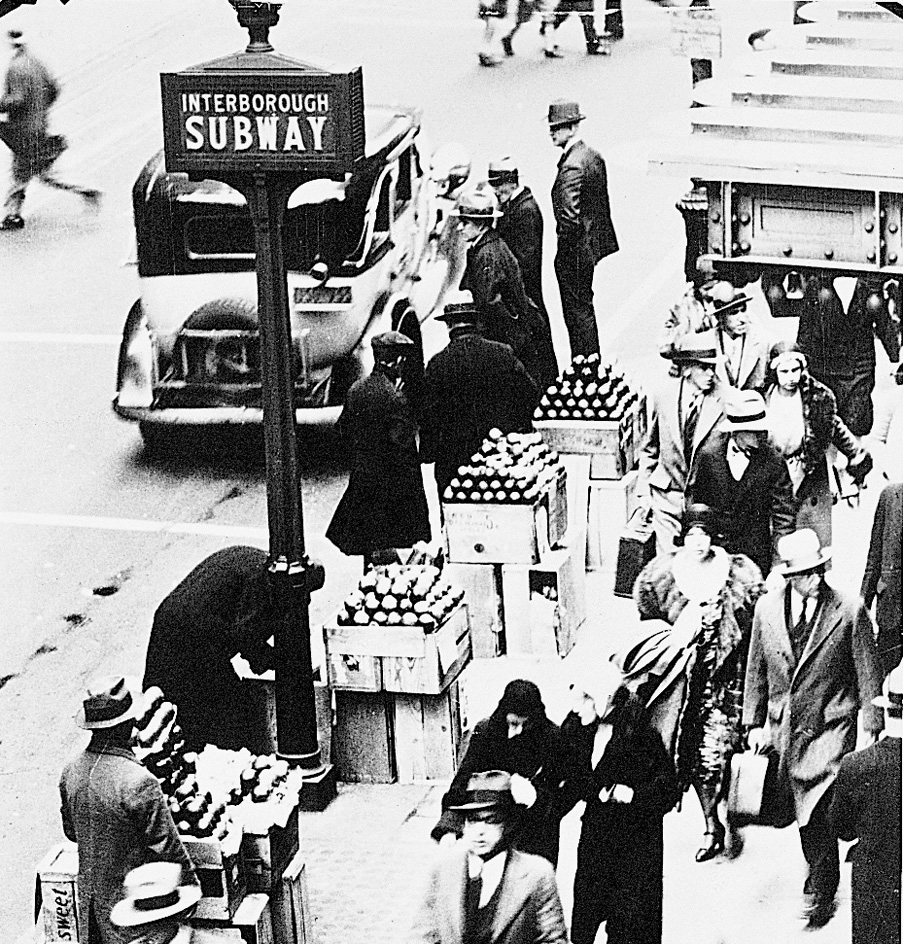

In 1925, about 3 percent of the nation’s workers were unemployed. The unemployment rate reached about 9 percent in 1930 and about 25 percent—or about 13 million people—in 1933. Many people who kept or found jobs had to take salary cuts. In 1932, wage cuts averaged about 18 percent. Many people, including college graduates, felt lucky to find any job. A popular song of the 1930’s called “Brother, Can You Spare a Dime?” expressed the nationwide despair.

World trade collapsed during the Great Depression, due in part to the Smoot-Hawley Tariff Act of 1930. This law greatly increased a number of tariffs on a variety of imported goods. President Hoover signed the law because he thought it would reduce competition from foreign products. But other nations soon reacted by raising tariffs on imported goods.

Declining prices were a serious problem during the Depression, as farmers and businesses received less money for their products and services. From 1929 to 1933, consumer prices fell by about 25 percent and prices of farm goods fell more than 50 percent. Farmers produced a surplus of crops, which pushed prices down because there was more food than people could buy. Falling prices led to rising debt burdens for borrowers and bankruptcy for many farmers. In addition, falling prices caused many consumers to delay purchases because they anticipated that prices would be even lower in the future.

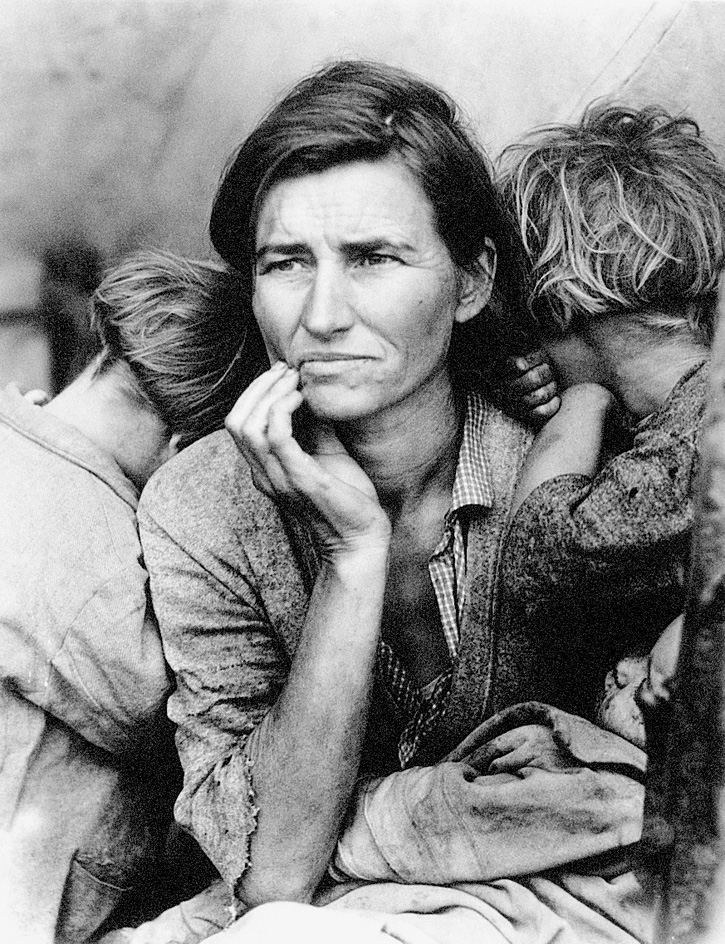

Human suffering

became a reality for millions of Americans as the Depression continued. Many died of disease resulting from malnutrition. Thousands lost their homes because they could not pay their mortgages. In 1932, at least 25,000 families and more than 200,000 young people wandered through the country seeking food, clothing, shelter, and a job. Many youths traveled in freight trains and lived near train yards in camps called hobo jungles. Some homeless, jobless travelers obtained food from welfare agencies or religious missions in towns along the way. Many travelers became ill because they lacked proper food and clothing.

Many people who lost their homes remained in the community. Some crowded into the home of a relative. Others moved to a shabby section of town and built shacks from flattened tin cans and old crates. Groups of these shacks were called Hoovervilles, a name that reflected the people’s anger and disappointment at President Herbert Hoover’s failure to end the Depression.

The Depression did not affect all groups equally. In most U.S. cities and in the South, unemployment rates were much higher for African Americans than for whites. Similarly, women often faced greater difficulty finding jobs than men did. The suffering of the Depression also brought heightened discrimination against Mexican Americans. Many people considered them a drain on the economy because they held many low-paying jobs while other Americans went unemployed. During the 1930’s, thousands of Mexican Americans were deported against their wishes.

In 1932, many farmers refused to ship their products to market. They hoped a reduced supply of farm products would help raise the price of these goods. Such farmers’ strikes occurred throughout the country, but they centered in Iowa and the surrounding states.

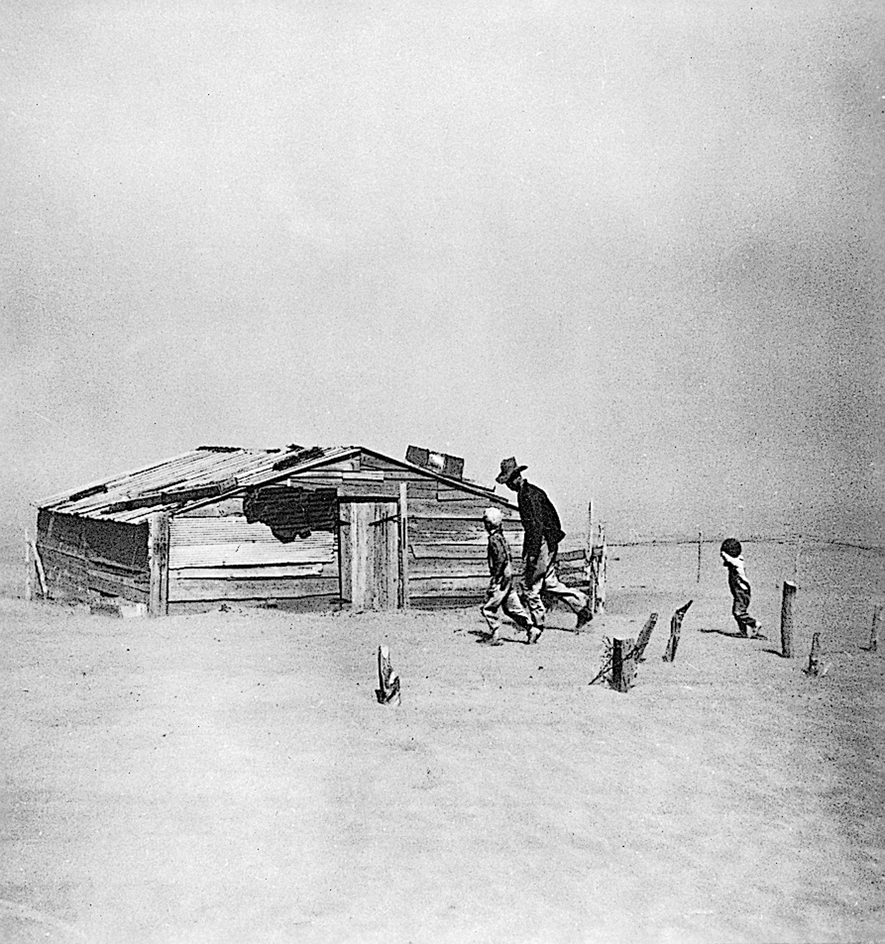

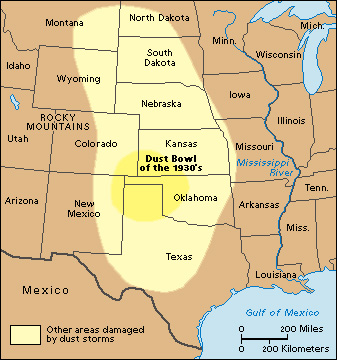

Severe droughts and dust storms hit parts of the Midwest and Southwest during the 1930’s. The afflicted region became known as the Dust Bowl, and thousands of farm families there were wiped out. Some farmers fled to the fertile agricultural areas of California to look for work. Most who found jobs had to work as fruit or vegetable pickers for extremely low wages. The migrant families crowded into shacks near the fields or camped outdoors. The American author John Steinbeck’s famous novel The Grapes of Wrath (1939) describes the hardships some migrant families faced during the Depression. See Dust Bowl .

U.S. policies to combat the Depression

Hoover’s policies.

President Hoover believed that business, if left alone to operate without government supervision, would correct the economic conditions. He vetoed several bills aimed at relieving the Depression because he felt they gave the federal government too much power.

Hoover declared that state and local governments should provide relief to the needy. But those governments did not have enough money to do so. In 1932, Congress approved Hoover’s most successful measure for fighting the Depression, the Reconstruction Finance Corporation (RFC). This agency provided some relief by lending money to banks, railroads, and other large institutions whose failure would have made the Depression even worse. However, most Americans felt that Hoover did not do enough to fight the Depression, and voters elected Franklin D. Roosevelt president in 1932. See Hoover, Herbert Clark (Hoover’s administration (1929-1933)) .

The New Deal.

Roosevelt believed the federal government had the chief responsibility of fighting the Depression. He called Congress into a special session, now called the Hundred Days, to pass laws to relieve the Depression. Roosevelt called his program the New Deal.

The laws established by the New Deal had three main purposes. First, they attempted to provide relief for the needy. Second, they sought to aid recovery by providing jobs and by forming partnerships between government, consumers, and businesses. Third, the laws tried to reform business and government so that such a severe depression would never happen again.

Congress created several agencies to manage relief programs. The Federal Emergency Relief Administration (FERA), founded in 1933, gave the states money for the needy and helped local charities with relief efforts. The Civilian Conservation Corps (CCC), also established in 1933, employed thousands of young men in conservation projects. The Public Works Administration (PWA), another agency founded in 1933, provided money and jobs for the construction of bridges, dams, and schools. The Works Progress Administration (WPA), created in 1935, provided jobs in public projects such as road building, flood control, and the construction of airports, hospitals, schools, and parks. It also provided work in the arts. In 1939, this agency’s name was changed to Work Projects Administration. These work relief programs provided several million jobs during the Depression, but unemployment remained high throughout the 1930’s.

Some New Deal agencies established and managed recovery programs. The Agricultural Adjustment Administration (AAA), set up in 1933, transformed agricultural markets by regulating farm production. The National Recovery Administration (NRA), also created in 1933, set up and enforced rules of fair practice for business and industry. The codes enforced minimum wages and maximum hours of work, set limits on output, and established minimum prices. However, this partnership with business showed little effect on stimulating the economy, and the codes were ruled unconstitutional in 1935.

Congress created several agencies to supervise banking and labor reforms. To restore confidence in the banking system, the Federal Deposit Insurance Corporation (FDIC) was established in 1933 to insure commercial bank deposits. The Securities and Exchange Commission (SEC), created in 1934, regulated stock markets and tried to protect investors from buying unsafe stocks and bonds. The National Labor Relations Board (NLRB), created in 1935, worked to prevent unfair labor practices and to protect workers’ rights to form and join unions. In 1935, Congress passed the Social Security Act to provide money for retired and unemployed individuals.

The recovery from the Depression.

The New Deal programs helped relieve some of the worst human suffering of the Depression. The government also increased trade by lowering tariffs on certain imported goods. In return, other nations lowered tariffs on some products that they imported from the United States. However, the economy substantially improved only after the United States abandoned the gold standard, devalued the dollar, increased the money supply, and helped the banking system to recover.

Despite the various government programs, about 15 percent of the nation’s working force still did not have a job in 1940. Unemployment did not substantially decline until 1942, after the country had entered World War II. The great increase in production of war materials provided so many jobs that the U.S. unemployment rate fell to about 1 percent in 1944. See New Deal ; Roosevelt, Franklin Delano (Roosevelt’s first administration (1933-1937)) .

The Depression throughout the world

Effects in Canada.

At the time of the Great Depression, Canada’s national economy depended on the export of grain and raw materials. Canadian farmers and exporters suffered huge losses after other countries increased tariffs on imported products and farm prices continued to fall. Many Canadian companies closed, and the unemployment rate rose from about 3 percent of the labor force in 1929 to about 23 percent in 1933.

Richard B. Bennett, who served as prime minister from 1930 to 1935, had little success in his efforts to relieve the Depression in Canada. W. L. Mackenzie King succeeded Bennett and adopted programs similar to those of Roosevelt to fight the Depression. See Bennett, Richard Bedford ; King, William Lyon Mackenzie ; Canada, History of (The Great Depression) .

Effects in Europe.

People in Europe faced homelessness and unemployment at alarming rates. Studies carried out in the United Kingdom between 1934 and 1938 showed that 19 percent of the people were on a substandard diet. Hunger marches—the most famous being one in 1936 from Jarrow, in northeastern England, to London—were attempts to gain publicity for the plight of thousands of people.

Effects in Australia.

The rate of unemployment was even higher in Australia than that recorded in the United States and the United Kingdom in the worst years. Economic historians estimate that 30 percent of the work force in Australia was unemployed in 1932. Exports fell dramatically in 1930, and prices dropped steadily from 1930 to 1933. As in Europe, extremist politics appeared in Australia. Many people voted for the Communist Party and backed New State movements, which supported setting up a number of separate states from those that already existed.

Long-term effects of the Depression

New government policies.

Following the Great Depression, many countries began to provide better welfare benefits for the poor. In the United States, laws of the New Deal gave the government more power to provide money for the needy and the elderly. Since the Depression, both Democratic and Republican administrations in the United States have broadened the powers of the federal government.

In addition, many governments changed their basic philosophy of spending as a result of the Great Depression. Before the Depression, they had tried to spend the same amount of money as they collected, even during economic downturns. But since the 1930’s, governments have been more willing to reduce taxes or increase government purchases to stimulate production and spending. In addition, they have gained greater understanding of how central banks can help fight recessions by changing the money supply and interest rates.

New public attitudes.

The Great Depression changed the attitudes of many people toward business and government. Before the Depression, many people regarded bankers and business executives as national leaders. After the stock markets crashed and these leaders could not relieve the Depression, people lost faith in them. As a result, many people decided that the government—not business—had the responsibility to manage the national economy.

The Depression also changed people’s attitudes toward unemployment. People came to view unemployment not as a personal shortcoming but as a condition that can result from circumstances beyond the individual’s control.