Money is anything accepted by members of a community in exchange for the things they sell or the work they do. Economists, the scholars and researchers who study how people produce and distribute goods and services, say that money used in this way serves as a medium of exchange. Money can also be used as a store of value—that is, people can save it for future purchases and living expenses. Finally, money serves as a unit of account. People state the price of goods and services in terms of money, just as they use hours to express time and miles or kilometers to measure distance.

Most objects used as money share at least three traits. (1) The objects are durable and portable. Things that are easily broken or that cannot readily be taken to the marketplace are difficult to use as money. (2) The objects are easy to quantify (count). For an object to be useful as money, people must be able to see how much of it exists and to know its value. (3) The objects are rare, but not so rare that people in the group are unfamiliar with them. If an item is too common, people will not trade valuable things for it. But objects used as money cannot be too rare. Everyone in the community needs to know about the object, agree that it has value, and want it.

Items used as a medium of exchange in ancient times included copper, dyes, grain, livestock, weapons, and wine. Early cultures often used objects as money that were desirable in themselves in addition to having monetary worth. For example, bronze coins could serve as money, but people could also melt them down and use the metal for making tools. This type of money is known as commodity money. Other types of commodity money have included gold, silver, and salt.

In modern times, money has consisted mostly of metallic disks called coins and officially approved, printed pieces of paper called notes. Each country has a basic unit of money. In the United States, for example, the basic unit is the U.S. dollar. Australia, Canada, and New Zealand use dollars of their own. Japan uses the yen, Mexico the Mexican peso, Russia the Russian ruble, Switzerland the Swiss franc, and the United Kingdom the British pound. Much of Europe uses the euro. The money in use in a country is called its currency.

Over time, money has become more abstract—that is, more a representation of value than an object of value itself. An early shift toward abstract money occurred in Europe in the 1600’s when commodity money, such as gold coins, began to be represented by paper money. By the 1900’s, money became yet more abstract. At that time, most governments went off the gold standard (the use of gold as the standard of value for money)—that is, they ended any promise to pay gold for paper money. Paper money then became fiat money—money that a government guarantees to be legal currency, but that cannot be redeemed for any commodity and that has no value in and of itself.

In the 1990’s, physical currency began to be replaced by new, electronic forms of money, such as debit cards. With electronic money, data represent the amount of money in a banking account. The holder of the account might rarely, or even never, pay physical currency into the account or take physical currency out from it. The development of electronic forms of money continues a further level of abstraction for money.

Whether money consists of pieces of metal or paper or of electronic data on a debit card, people exchange it for work or goods for only one reason: They know that others will accept the same metal or paper or electronic data in exchange for the things they want. The value of money therefore results from the fact that everyone will accept it as payment.

How money developed

Before agriculture, people got their food by hunting wild animals and gathering wild plants. Hunters and gatherers exchanged most items that they needed among members of a family or clan. It was not difficult to remember obligations within such a small group. As human societies developed from a hunting and gathering lifestyle to an agricultural one, economic exchanges became more complex.

Only when humans began living in communities that practiced farming instead of hunting and gathering did money become necessary. Agriculture allowed communities to grow much larger than they could under a hunting and gathering system. The simple social relationships of a small society gave way to far more complex relationships that were difficult to track. People required a more universal medium of exchange to get the things they needed.

Objects used as money

To curb the problem of debasement, some ancient cultures appointed an expert to examine money. When the expert found a piece of money that was good, the expert put an identifying mark on it for all to see. Merchants then began doing this marking, and governments soon followed. When governments began stamping a mark on metal pieces to show that they were acceptable as money, the governments created the longest-lived monetary object in the history of the world—the coin.

Early coins

Lydian coins

were made of precious metals—usually gold, silver, or a mixture of the two called electrum. To make a coin, the Lydians took metal and formed it into a ball. They placed the metal ball between two dies (stamping forms). Then, they struck (made) the coin by hitting the upper die with a hammer. In the beginning, only the bottom die, into which the ball of metal was driven, had a real design. For example, the design might be the badge of the king or that of the authority issuing the coins. The upper die was unmarked.

The Lydians quickly improved their coin-making process. They began carving a design into the upper and the lower die. This technique made a coin with a design on each side—on the obverse (front) and the reverse (back). This method of making coins spread from Lydia to the islands and mainland of Greece, then to Rome, and from there to much of Europe and some parts of Africa.

Chinese coins.

The date of the invention of Chinese coins is difficult to establish. Historians know, however, that people in China produced coins by the time coins developed independently in Lydia.

The first Chinese coins were shaped like miniature spades and knives—valuable tools in a farming society. Soon, the Chinese began to make coins called cash. Cash were round coins with a square hole in the center cast in copper, bronze, or brass. The hole allowed them to be strung on a cord. The cash had little purchasing power, and so even a medium-sized purchase took a large number of cash. Cash were commonly used in strings of 100 or 1,000 coins. The strings of coins were bulky and inconvenient to carry and use.

The Chinese method for making coins spread through east and southeast Asia to such nations as Japan, Korea, and Vietnam. The last nation to make Chinese-style coins was Vietnam, which produced round cash with a square center until the mid-1900’s.

Coins in east and southeast Asia had important differences from coins created in Europe. (1) Asian coins were generally made of base metals—copper, brass, and occasionally iron—rather than precious metals. (2) Coins made in Asia were cast—that is, metal was melted and poured into molds to create a coin. (3) Not all Asian coins were round.

Indian coins.

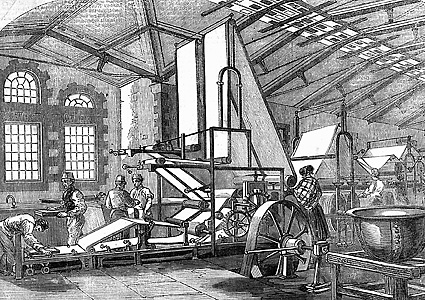

Modern coins

are still made using the same basic method as Lydian coins, by placing metal between two dies and then applying downward force. But instead of a human supplying the force with a hammer, modern coins are made with machines.

Mechanical presses that made coins were introduced in Europe in the 1500’s and spread worldwide over the next few centuries. Machine presses led to the introduction of a third die to work with the other two. The third die consists of a ring-shaped steel collar that surrounds the metal as the coin is struck. The third die prevents the metal from spreading beyond the top and bottom die. This third die became necessary because the mechanical press produced increased striking pressure.

Coins pressed by machine are more uniform than hand-struck coins. Most coins made by machine also have a design that is shallower in depth. It requires less force to strike a coin with a design in shallow relief, and this reduction in force allows the dies to last longer.

Machines also allow far more coins to be struck. For example, the United States Mint, using hand-operated presses, struck fewer than 250,000 one-cent coins during all of 1809. Two centuries later, the Mint strikes that many one-cent coins every five minutes.

Although mints now can strike as many coins as an economy needs, the value of a coin in itself has all but disappeared. At one time, coins were made of a precious metal that, taken with the cost of manufacturing the coin, equaled the coin’s stated value. In the United States and Europe, such coins were made of gold. Most nations, including the United States, phased out the use of gold coins in the 1930’s as a response to the worldwide economic slump called the Great Depression. By 1970, the United States also stopped creating coins in silver to be used as currency. Mints still create gold, silver, and platinum coins, but only for collectors, not for commerce.

By the late 1900’s, circulating coins were made of materials with little value. Common materials included aluminum-bronze, copper-plated zinc, and stainless steel. But the role of coins changed. When made of gold or silver, coins were the workhorse of the economic system. Now, people use coins only for minor purchases, such as a newspaper or a soft drink. Major purchases take “real” money—either paper or electronic money.

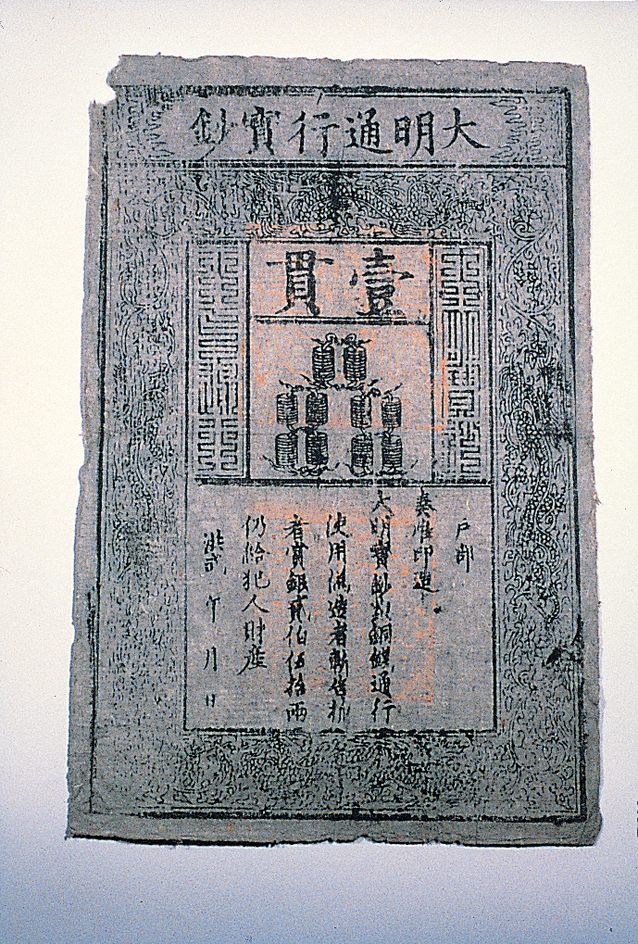

Paper money

The government, however, found paper money too convenient at times. Coins are made of metals that have to be taken out of the ground and processed. Then coins need to be struck from the metal. Only a limited number of coins can be made at a given time. With paper money, it was easy to create large amounts of money quickly. One needed only to write the desired denomination on a piece of paper. This made it easy for the government of China to rapidly increase the amount of money circulating in the economy. When more money is added to an economy that is creating the same amount of goods and services, money loses some of its purchasing power. We call this effect inflation. China had several instances of extreme inflation caused by the government printing too much money. Later, when Europe and the United States adopted paper money, the problem of adding too much money into an economy too quickly and subsequent inflation arose in those places as well.

The Italian traveler and merchant Marco Polo brought news of China’s paper money back to Europe, but his description had little immediate effect. People in Europe occasionally used promissory notes for exchange during the Renaissance, a great cultural movement that began in Italy in the 1300’s and ended about 1600. But these notes did not lead to modern paper money.

History of the pound

For hundreds of years, the British pound consisted of 20 shillings. Each shilling was divided into 12 pence, so there were 240 pence in a pound. Because the currency was based on silver, it was known as the pound sterling.

British pounds, shillings, and pence spread throughout the world during the 1700’s and 1800’s, when Britain built a great colonial empire. Many parts of the British Empire, including what today are the independent nations of Canada, Australia, and New Zealand, used British currency.

Although Canada used pounds, shillings, and pence, the Canadian pound did not equal the British pound in value. In 1858, Canada switched to a system of decimal currency, based on units of 10 or multiples of 10. The country’s new unit of currency was the Canadian dollar, divided into 100 cents.

In the 1900’s, the United Kingdom gave up most of its empire and helped many countries achieve independence. The newly independent countries then adopted their own currencies. Australia began producing its own coinage in 1910. In 1966, Australia changed its currency to the Australian dollar. In 1933, New Zealand separated the New Zealand pound from the British pound. The New Zealand dollar replaced the New Zealand pound in 1967.

The United Kingdom, Canada, Australia, and many other countries went off the gold standard in the 1930’s. Britain stopped circulating sovereigns in 1932.

In 1971, the United Kingdom switched to a system of decimal currency. Under the new system, the pound was divided into 100 pence.

History of United States currency

English settlement in what would become the United States began in Virginia, shortly after 1600. By the 1640’s, a number of British settlements existed. The settlements grew, but they lacked one essential ingredient for economic success—local supplies of gold and silver.

A scarcity of money.

Britain did not furnish coins to the American Colonies and forbade the colonies to make them. This policy made currency in the colonies scarce. The British hoped that by keeping money scarce in the colonies, they could force the colonists to trade almost entirely with England. Without money, the colonists could not do business with traders in other countries.

Early American colonists used a variety of goods in place of money, including beaver pelts, grain, musket balls, and nails. Some colonists, especially in the tobacco-growing colonies of Maryland and Virginia, circulated receipts for tobacco stored in warehouses.

Tree shillings.

Even with foreign coins, the lack of local precious metals and money hampered the development of the English colonies. The colonists of Massachusetts came up with a solution. Massachusetts carried on a growing, though illegal, trade with Spanish America. Traders exchanged rum from Boston and timber from New England for silver coins from Mexico, Peru, and Bolivia. The colonists decided to open a mint that would take the Spanish American silver coins and refashion them into Massachusetts coinage.

The Boston mint closed in the early 1680’s. Massachusetts and the other colonies needed a monetary system, so they began using paper.

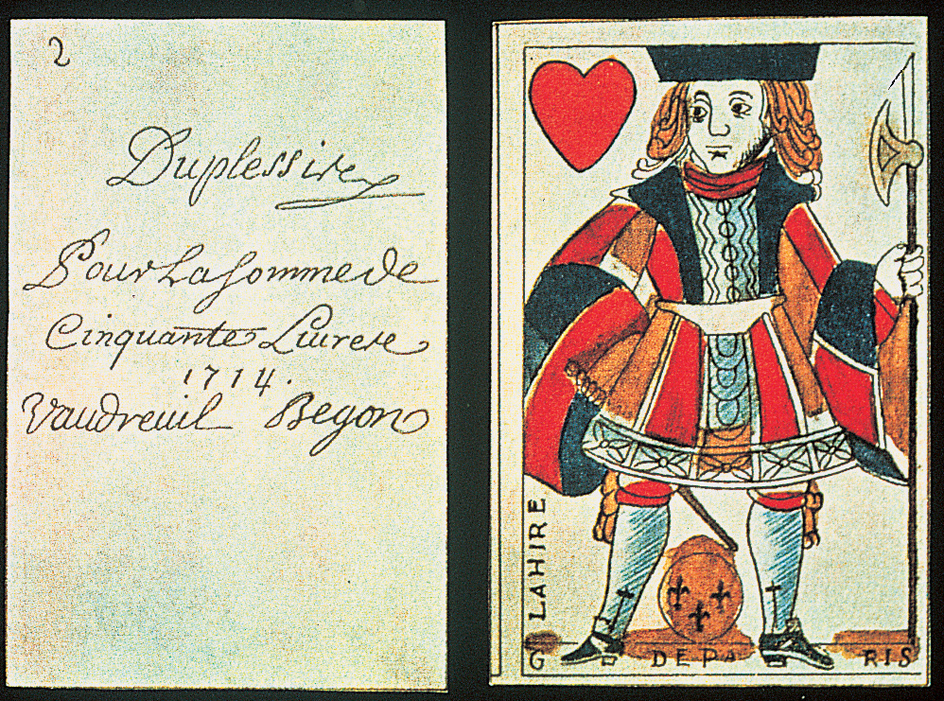

Bills of credit.

France and England fought a series of four wars for control of eastern North America from 1689 to 1763. England expected Massachusetts to do its part by raising and supplying troops to fight the French in Canada. But it was impossible for the colony to do so. Since Massachusetts had lost its silver coinage, it had no “real” money. As a result, the colonial government of Massachusetts began in 1690 to issue notes called bills of credit. The bills were receipts for loans made by citizens to the colonial government. Massachusetts used the bills to raise, equip, and pay troops. Because England had guaranteed repayment in coin on these bills, the paper money had a firm guarantee.

The bills of credit remained in circulation after the war. Soon, they became an acceptable currency for the payment of taxes in Massachusetts. A new form of money had appeared—paper notes issued and guaranteed by the government. Massachusetts became the first place in the Western Hemisphere to issue paper money.

Americans soon regarded paper currency not just as a wartime necessity but as a huge convenience. Soon, the currency paid for building a lighthouse on an island in Georgia and a poorhouse in Philadelphia. Americans eventually used the currency for all manner of purchases, public and private.

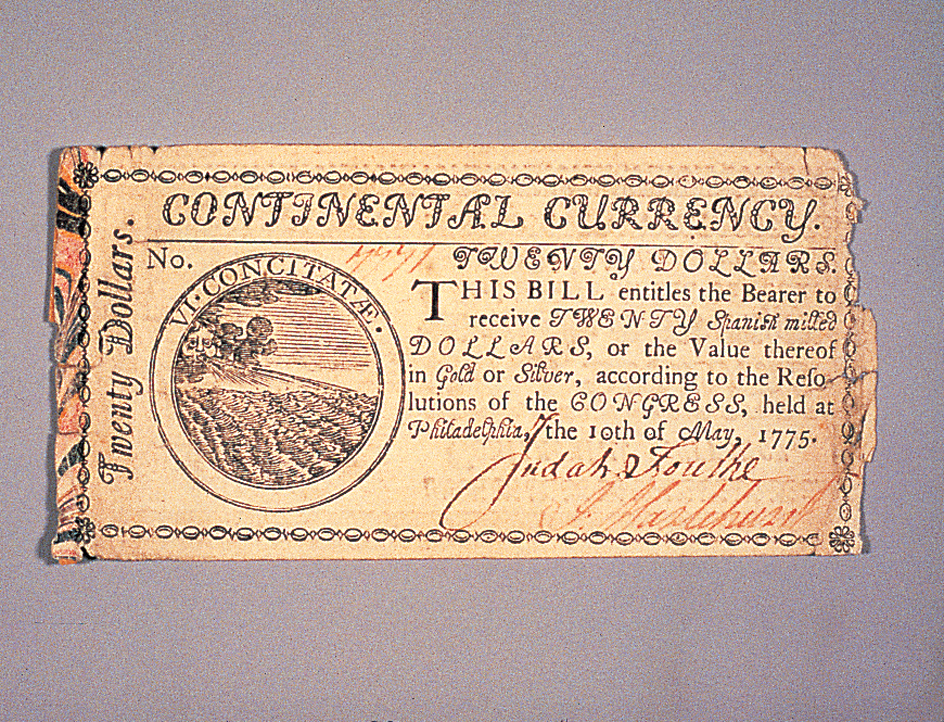

Continental currency.

But the currency failed when the colonists needed it most. It had worked previously because the British government promised to redeem it in coinage. This guarantee gave people faith in the money. But the British government would not guarantee paper currency issued by colonists rebelling against it.

Colonial paper money might have retained its value if the colonists had won a decisive and swift victory in the American Revolution (1775-1783). But when victory proved difficult, colonial currencies began to lose value.

By 1780, the Continental Congress, a gathering of delegates from the colonies that served as a national legislature, gave up issuing more currency. At that point, the Congress had issued some $240 million of currency called continentals. That amount was enough to purchase every house, farm, and factory in the colonies—if anyone could be found who would take a continental note. The states had issued a similar amount of currency. Continental currency and state currencies circulated at a 97 percent discount—that is, a $1 note was worth about 3 cents. The worst colonial currency had nearly no value. Virginia printed bills in the denomination of $2,000 in the early 1780’s that were worth about $1 in gold. Americans began to describe any useless thing as “not worth a continental.”

Money in the new United States.

Soon after winning independence, Americans began determining what the nature of the new nation’s money was to be. The new Constitution of the United States gave responsibility for issuing all coinage firmly to the federal government. States could no longer legally circulate their own coinage, as a number of them had been doing over the past few years. Nor were states allowed to issue bills of credit or paper money.

The framers of the Constitution said nothing, however, about the right of the national government to issue paper money. They realized that the central government might have to issue such money to survive during some crisis. But the Founding Fathers preferred that the federal government issue no paper money, and this preference largely held for the next 70 years. They meant the United States to be a country with one form of money, the coin.

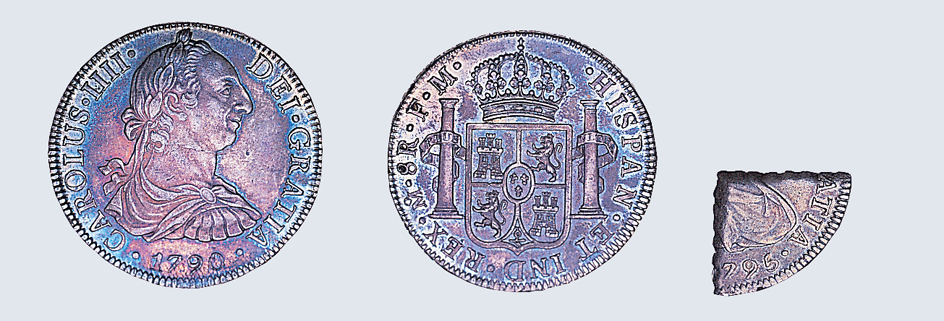

The government opened a new mint in the national capital, Philadelphia. The mint had little effect, however, because the nation still lacked precious metal with which to make coins. Americans continued to use many foreign coins in addition to their new currency. A law passed in 1793 made these coins part of the U.S. monetary system. The value of a foreign coin depended on how much gold or silver it had. In 1857, Congress passed a law that finally removed foreign coins from circulation in the United States.

Privately issued bank notes.

Even using foreign coins as U.S. currency, the shortage of money led the United States to a crisis by the mid-1790’s. A few banks began issuing paper money during the 1790’s, followed by hundreds of other banks over the next decades. From 1790 to about 1860, there were approximately 8,000 organizations in the United States that issued notes. Most were banks. But other groups also issued notes, including railroads, canals, lyceums (lecture halls), a hotel in Illinois, and even an organization that claimed to be an orphans’ institute in Ohio.

Each group promised to exchange its notes on demand for gold or silver coins. But many did not keep enough coins to redeem their notes, which made the notes worth less than face value (the value stated on them). As a result, people hesitated to accept bank notes. Despite the drawbacks to this form of currency, however, it made possible the industrial and agricultural progress achieved by the United States before 1860.

The United States acquired California and much of the West from Mexico in 1848, and gold and silver were discovered in the new territories. For the first time in U.S. history, the country had the raw materials to create as many coins as it would ever need. The persistent scarcity of money came to an end, and efforts to make coins the only U.S. currency seemed about to succeed.

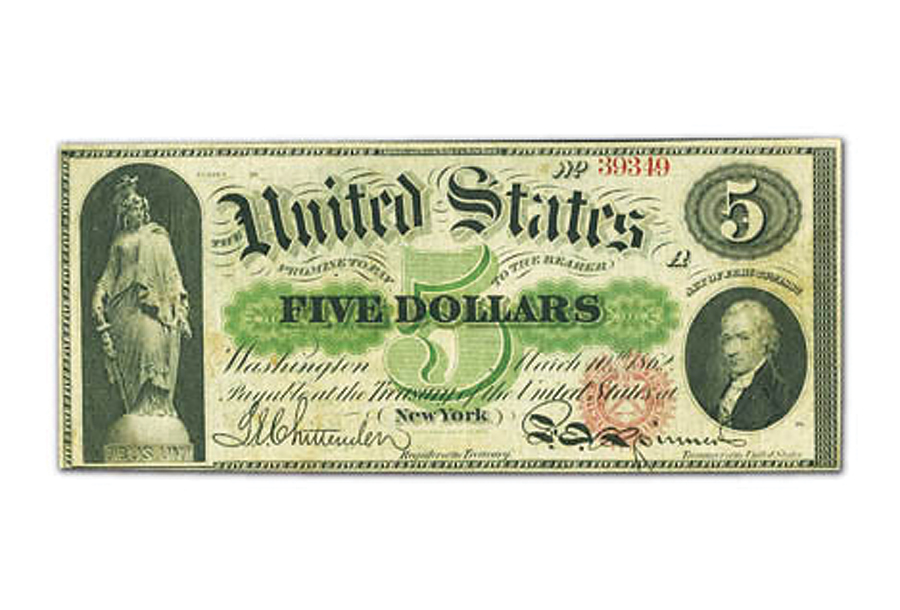

Money in the American Civil War.

Most of the Southern, slaveholding states left the Union during the winter of 1860-1861. The states that split from the Union formed the Confederate States of America. In 1861, the North and South went to war. To meet the expenses of the American Civil War (1861-1865), the Confederacy began issuing paper money.

In a sense, the monetary situation of the South was easier than that of the North. Having left the Union, the Southern States were no longer subject to the Constitution and were free to issue paper money. The value of Confederate money fluctuated. As the war began to go badly for the South, the value of Confederate currency dropped. It became worthless by the war’s end.

The Union also turned to paper money to finance its war effort. By 1861, the Union government devised a way of circulating federal paper money. The new bills were called Demand Notes because they were payable in coinage “on demand.” People could only redeem the notes at a limited number of places, however. By 1862, the government completely suspended payments in coins. The new federal notes were privately printed because the country had no national printer at this time. The color used for the backing of the notes gave them a popular name still in use today—greenbacks.

In 1865, Congress passed a tax on notes issued by state banks that were not chartered. The tax effectively put an end to paper money not issued by the federal government. The shape of modern American money began to emerge. There would be a single issuer of money, the U.S. federal government. It would take responsibility for all money—gold, silver, minor coins, and all paper currency. The era of private money—ranging from California gold coins to currency from railroads, banks, and individuals—ended.

The U.S. government has occasionally introduced new types of federal paper money, such as silver certificates and gold certificates. Both types of certificates could be redeemed for a precious metal through the 1960’s. But all of the other variants eventually yielded to the Federal Reserve Note, the only type of paper money most Americans have ever used.

Federal Reserve Notes.

Congress created the Federal Reserve System (also called the Fed) in 1913 in response to a number of banking panics and crises in the early 1900’s. The Fed acts as the central bank for the United States—that is, the government agency that controls credit and currency, and tries to stabilize economic activity. The Fed is made up of the Federal Reserve Board and 12 Federal Reserve Banks.

From the beginning, each Federal Reserve Bank issued its own notes. They were designated by a special number, from 1 to 12, and later by a letter, from A to L. The panics that led to the creation of the Fed soon waned. Federal Reserve Notes became one more type of United States currency among many.

During the Great Depression of the 1930’s, the banking system in the United States nearly collapsed. The crisis brought major changes to the U.S. monetary system. The administration of President Franklin D. Roosevelt believed that the Federal Reserve System offered a way of keeping the money supply stable. The Fed can expand the supply of money during economic recessions and depressions. It can also contract (reduce) the money supply when inflation becomes a problem. For this expansion and contraction to work, the government had to eliminate forms of paper money other than those issued by the Fed. The federal government retired gold certificates in 1933 and National Bank Notes in 1935. The last time anything other than a Federal Reserve Note was issued for commerce was in 1966.

Modern U.S. currency

Modern U.S. currency consists of coins and paper money. Under federal law, only the Department of the Treasury and the Federal Reserve System may issue U.S. currency. The Treasury issues all coins. The Federal Reserve issues Federal Reserve notes.

U.S. coins.

Mints in Denver and Philadelphia make most coins for general circulation. Mints in San Francisco and West Point, New York, make mostly commemorative coins to mark special occasions. They also produce gold and silver bullion coins, which investors buy for their value as metals rather than as money. Some coins bear the mark D, P, S, or W to indicate where they were minted.

Federal law requires that coins be dated with the year they were made. Coins also bear the Latin motto E Pluribus Unum, meaning Out of Many, One. The motto refers to the creation of the United States from the original Thirteen Colonies. The word Liberty also appears on most U.S. coins. On some coins, the motto and date appear on the face on the coin. On other coins, these items appear on the edge. Most coins have a standard design for the front and back of the coin, but the U.S. Mint often issues special coins commemorating people and events.

Coins come in six denominations. These denominations are (1) penny, or 1 cent; (2) nickel, or 5 cents; (3) dime, or 10 cents; (4) quarter, or 25 cents; (5) half dollar, or 50 cents; and (6) $1. All modern coins in the United States consist of alloys (mixtures of metals).

Pennies

consist of copper-coated zinc and have a smooth edge. A portrait of Abraham Lincoln appears on the front. On the back, pennies have an image of the Lincoln Memorial, a shield with the motto E Pluribus Unum, or a scene from Lincoln’s life.

Nickels

consist of a mixture of copper and nickel, and they also have a smooth edge. The nickel features Thomas Jefferson on the front and his home, Monticello, on the back.

Dimes

have three layers of metal. The core consists of pure copper. The outer layers are an alloy of copper and nickel. Dimes feature a portrait of Franklin D. Roosevelt on the front. The back shows a torch, standing for liberty; an olive branch, representing peace; and an oak branch, symbolizing strength.

Quarters

Half dollars

consist of a copper core between two copper-nickel layers. The coin features John F. Kennedy on the front and the American eagle on the back. Dimes, quarters, and half dollars all have ridges called reeding around the edge.

Dollar coins

come in several varieties. Though not now minted, a common $1 coin still circulating shows Dwight D. Eisenhower on the front and either the Apollo 11 moon landing or the Liberty Bell on the back. Susan B. Anthony, who fought for voting rights for women, appears on the front of the dollar named for her. The back of the Anthony dollar uses an adaptation of the Apollo 11 image from the Eisenhower dollar. Both the Eisenhower and the Anthony dollars consist of a layer of copper-nickel over a copper core, and both have a reeded edge. Neither of these coins became popular with the public. People frequently complained that $1 coins looked and felt too much like quarters.

U.S. paper money.

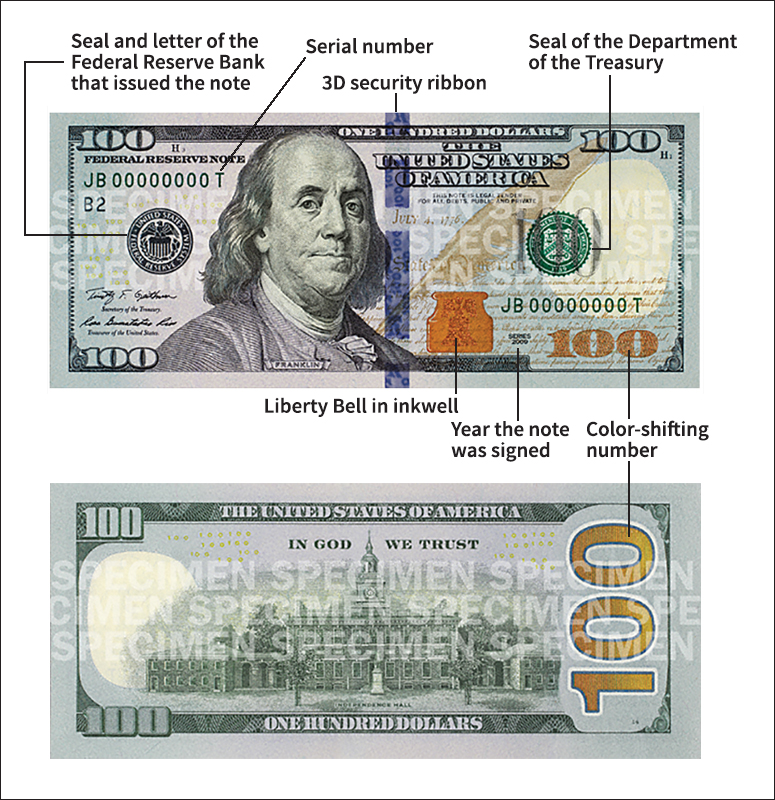

The $1 bill features a portrait of George Washington on the front and both sides of the Great Seal of the United States on the back. The $2 bill shows Thomas Jefferson on the front and the signing of the Declaration of Independence on the back. The $5 bill has a portrait of Abraham Lincoln on the front and the Lincoln Memorial on the back. Alexander Hamilton appears on the front and the U.S. Treasury building on the back of the $10 bill. Hamilton served as the first secretary of the treasury. The $20 bill features a portrait of Andrew Jackson on the front and the White House on the back. The $50 bill depicts Ulysses S. Grant on the front and the U.S. Capitol on the back. The $100 bill shows Benjamin Franklin on the front and Independence Hall on the back. Of commonly circulated currency, only two bills do not have a president on the front—the $10 and $100.

Until 1969, Federal Reserve Banks also issued notes in four large denominations: $500, $1,000, $5,000, and $10,000. These bills were intended to be used for transferring currency between banks, but modern systems of electronic transfer have made them unnecessary. Federal Reserve banks remove these large bills from circulation and destroy them when they receive them.

Other paper money circulating in the United States includes United States Notes. These notes, last printed in 1968, carry the words United States Note and a red Treasury Department seal. All Federal Reserve and United States notes bear the printed signatures of the persons who were secretary of the treasury and treasurer of the United States at the time the notes were issued.

In the 1990’s, the United States began issuing redesigned Federal Reserve Notes, starting with a new $100 bill in 1996. The government issued new $50, $20, $10, and $5 bills in the years that followed. The redesigned bills had features intended to make them harder to counterfeit. These features included a special watermark and a “security thread” that glowed in the dark when exposed to ultraviolet light. In 2003, the government introduced a second $20 bill, with additional features, including the use of subtle background colors to prevent counterfeiting. Similarly redesigned $100, $50, $10, and $5 bills followed. In 2013, the government again redesigned the $100 bill. The bill’s advanced security features include a blue, three-dimensional security ribbon woven into the paper; a color-shifting bell inside a copper-colored inkwell; and a portrait watermark of Benjamin Franklin on the front of the note. The government announced that it would redesign bills every 7 to 10 years to keep up with advances in counterfeiting.

How money is manufactured

Two agencies of the U.S. Department of the Treasury manufacture currency. The United States Mint makes coins, and the Bureau of Engraving and Printing produces paper money.

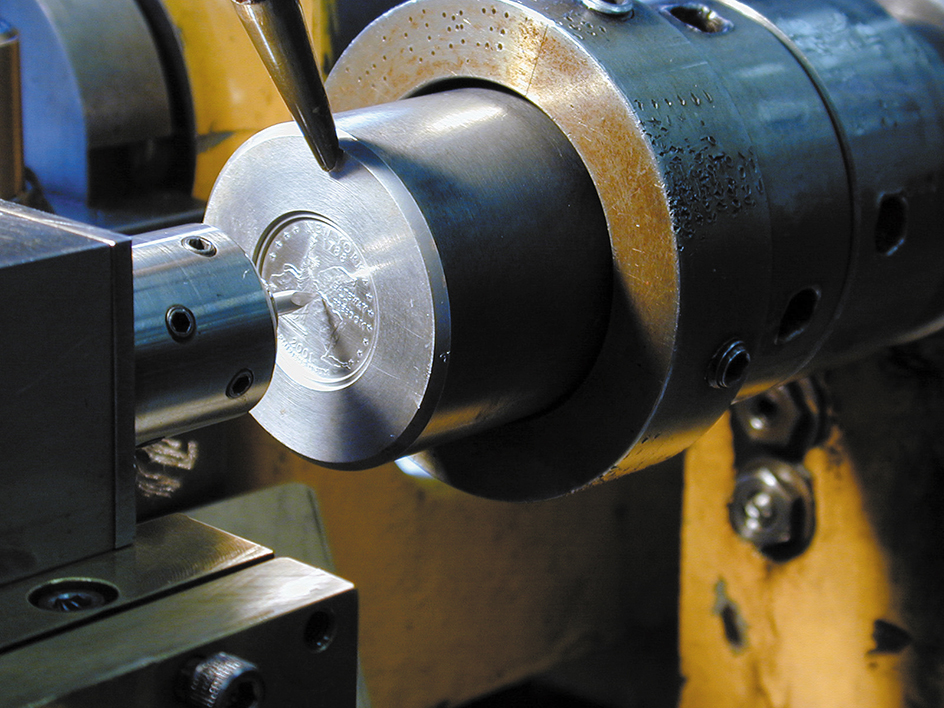

Minting coins.

The production of a new coin begins with artists’ proposed designs for the coin. After government officials select a design, an artist constructs a large clay model of the coin. Most models are about eight times the size of the finished coin. The artist does not add details because the clay is too soft. Instead, the artist makes a mold of the clay model and then creates a plaster cast from the mold. The plaster is hard enough to enable the artist to carve fine details. A machine called a reducing lathe traces the finished plaster model and carves the design, reduced to coin size, onto a soft piece of steel called a master hub. The master hub is heat-treated to harden it. A special machine takes an impression of the hub to make a set of steel tools called master dies. These dies are used to stamp copies of the master hub called working hubs. The working hubs, in turn, make working dies, which stamp the coins. The master hub and master dies are stored and used to make more hubs and dies after the first ones wear out.

Bars of metal are heated and squeezed between heavy rollers into strips the thickness of a coin. A machine punches out smooth disks of metal, called blanks, from the strips. The blanks are the size of coins but have no design. The blanks are fed into an upsetting machine, which puts a raised rim around the edge of each one. Then, they are fed into a coining press. The press uses two working dies to impress the coin’s design on both sides of each blank in one operation. The press also reeds the side of the coins with a ridged edge or stamps on any necessary dates or mottoes.

The Mint ships the finished coins to Federal Reserve Banks for distribution to commercial banks. The Reserve Banks also remove worn and damaged coins from circulation. The Mint melts them and uses the metal to make new coins.

Printing paper money.

The production of a new bill begins when artists sketch their designs for it. The secretary of the treasury must approve the final design. Engravers cut the design into a steel plate. A machine called a transfer press squeezes the engraving against a soft steel roller, making a raised design on its surface. After the roller is heat-treated to harden it, another transfer press reproduces the design from the roller 32 times on a printing plate. Each plate prints a sheet of 32 bills. Separate plates print the two sides of the bills.

Many people believe the paper used for money is made by a secret process. But the government publishes a detailed description of the paper so private companies can compete for the contract to manufacture it. A U.S. law forbids unauthorized people to make any type of paper similar to that used for money.

The Bureau of Engraving and Printing uses high-speed presses to print sheets of paper currency. The presses print the design first. Then the seals and serial numbers are added. The sheets are cut into stacks of bills. Imperfect bills are replaced with new ones called star notes. Each star note has the same serial number as the bill it replaces, but a star after the number shows that it is a replacement. The bills are shipped to Reserve Banks, which distribute them to commercial banks.

Most $1 bills wear out after about 18 months in circulation. Larger denominations last for years because they are handled less often. Banks collect worn-out bills and ship them to Federal Reserve Banks for replacement. The Reserve Banks shred worn-out money.

Money and the economy

The importance of money in an economy cannot be overstated. Money as a medium of exchange, unit of account, and store of value encourages people to exchange goods and services. If people could not use money to buy things, they would have to spend much of their time finding other people to trade with. Far fewer goods would be exchanged, which would lead to fewer goods being produced. Eventually, the standard of living would fall.

Although money benefits a society, the well-being of members of the society would not increase if the government simply printed large sums of money to give everyone. Money only benefits someone when it can buy something now or in the future. An economy can only produce a certain amount of goods and services. Economic production depends on available resources—workers, tools and machines, factories, land, and raw materials—and the productivity of these resources. If money were printed and given out to people every year, people would compete to buy the limited goods and services available. The result of that competition would be an increase in the prices of goods, services, and resources, but not an increase in the amount of things available. Only increases in resources, or improvements in technology that increase productivity, can give a lasting boost to production. Money does not, in this sense, help produce anything.

The money supply

in an economy is usually defined using either M-1 or M-2. Both M-1 and M-2 include assets that can either be used as a medium of exchange immediately or that can be made liquid (able to be used as a medium of exchange) quickly and easily.

M-1, the narrowest definition of the money supply, consists of currency (paper bills and coins in the hands of the public) and demand deposits (checking accounts in banks or debit accounts). Traveler’s checks also are included in M-1, but they make up a small fraction of the money supply. All of these things can be immediately used for purchases.

M-2 consists of M-1 plus other assets that can easily be cashed in to use for purchases. Economists call such assets near monies. Near monies include savings accounts at commercial banks, savings banks, and savings and loan associations. They also include small deposits that cannot be withdrawn before a certain date, such as certificates of deposit (CD’s); and money market mutual funds.

Although a customer can use a credit card to pay for things, using a card is in reality requesting a loan that must be repaid. Credit cards are not money, and so economists do not consider them part of the money supply.

Monetary policy.

Economic growth seldom remains steady over time. Economies experience what is called a business cycle, in which output grows, reaches a peak, then falls into recession. During a recession, output declines, usually for a half a year or more. Then the economy recovers with a new period of growth.

An nation’s central bank uses monetary policy—that is, changes to the money supply—to reduce inflation or to stimulate growth in a recession. A central bank can use expansionary monetary policy—that is, increases in the money supply—to reduce interest rates, which stimulates borrowing. Consumers may borrow money to buy expensive items. Businesses may borrow to buy such things as new machines. As a result, an increase in the money supply can reduce the severity of a recession by stimulating the total demand for goods and services in the economy. Economists call this total demand aggregate demand.

If aggregate demand grows faster than the economy can grow its output, however, inflation results. A central bank might then use contractionary monetary policy (decreases in the money supply) to reduce inflation.

Central banks increase and decrease the money supply through various means. One important way to affect the money supply is bonds. When a central bank buys government bonds from people and private banks, the bank puts more money into the economy, or increases the money supply. When a central bank sells bonds, it takes money out of the economy, or decreases the money supply.

Printing money and inflation.

When a government runs a deficit—that is, it spends more than it receives in taxes—for several years, it must finance the deficit. The government can either issue bonds that it must pay back in the future or print more money to cover the shortfall. When the money supply rapidly increases because the government is printing more money, hyperinflation—rapid, uncontrolled inflation that damages a nation’s economy—can result. There are many examples of hyperinflation created by governments. The economy of Germany soon after World War I (1914-1918) is a famous example. Once hyperinflation sets in, a government must place drastic restraints on the money supply to bring inflation down to manageable levels.

Money and international finance.