JPMorgan Chase & Co. is a major international financial institution. It makes loans, handles investments, and provides other financial services. Its headquarters are in New York City.

The firm traces its beginnings to the Bank of the Manhattan Company. Aaron Burr, who later became vice president of the United States, formed the Manhattan Company in 1799. The company was chartered to supply fresh water to a section of New York City. Its charter also allowed the company to use its profits for other financial activities, leading to the creation of the bank.

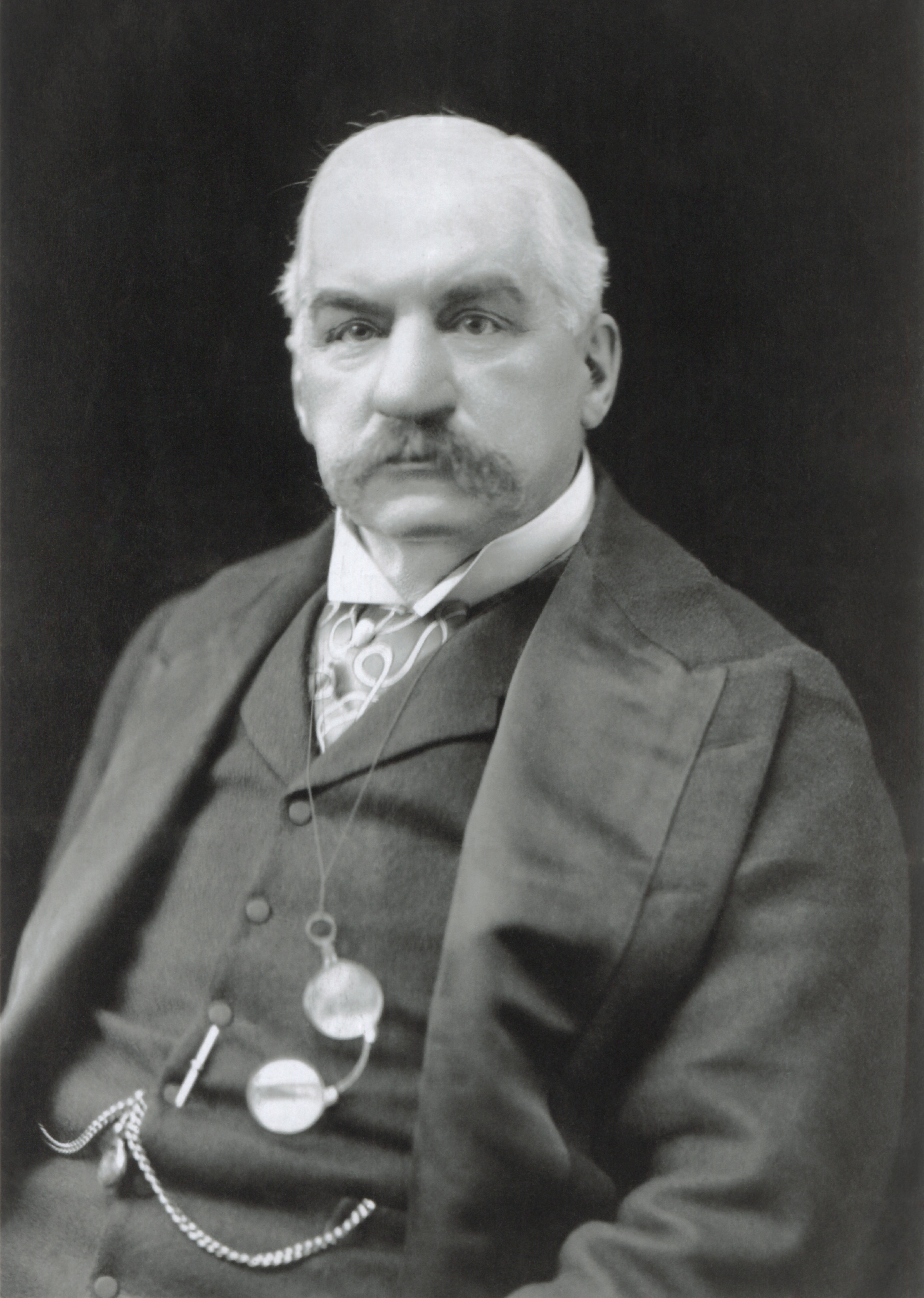

In 1871, J. P. Morgan, an American financier, formed Drexel, Morgan & Company. In 1895, the firm was reorganized under the name of J. P. Morgan & Company. In the 1890’s and early 1900’s, Morgan and his bank played an important role in solving national financial crises.

In 1955, the Bank of the Manhattan Company merged with the Chase National Bank. The resulting firm was called Chase Manhattan Bank. In 2000, Chase Manhattan merged with J. P. Morgan & Company. Another merger in 2004 created the modern company JPMorgan Chase & Co. In 2008, JPMorgan Chase & Co. acquired the investment bank Bear Stearns.

The bank and its chief officer, Jamie Dimon, were criticized for losses suffered in 2012. A nearly $6-billion loss stemmed from risky trades taken by a London division of the bank. Many of JPMorgan’s assets (money and items of value) are guaranteed by the U.S. government. Critics stated that the bank was following too risky an investment strategy given that the government could have to cover the bank’s losses. In November 2013, JPMorgan Chase & Co. agreed to a $13-billion settlement with the U.S. Department of Justice. The agreement settled charges that the bank and the companies it acquired had misrepresented the quality of mortgages sold to investors before the financial crisis that began in 2007.

In 2015, federal regulators fined JPMorgan Chase and five of the world’s biggest banks a total of $5.8 billion in a currency- and interest rate-rigging scheme. JPMorgan Chase and three of the banks—Citicorp, Barclays Plc, and The Royal Bank of Scotland Plc—pleaded guilty to criminal charges of conspiring to fix the price of U.S. dollars and euros traded on the foreign currency exchange market. A fifth bank, UBS AG, pleaded guilty to criminal charges of rigging key interest rates. The sixth bank, Bank of America, was fined $205 million in civil penalties in connection with the currency-rigging scheme.